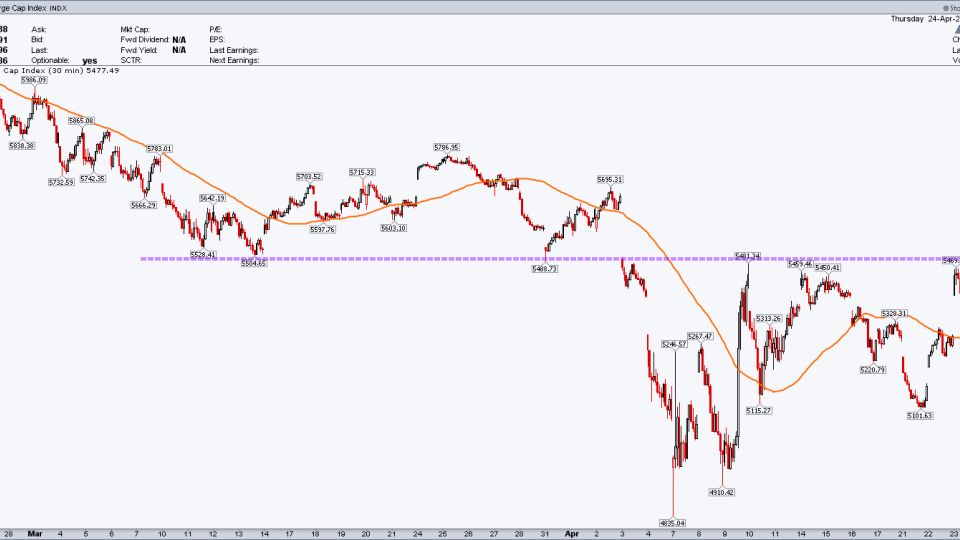

Saturday Morning Chartoons: Everything's Up!

July 19, 2025

All Star Charts Premium

Chartoons

Premium

Members Only

Displaying 1057 - 1080 of 18644

Recent Episodes

Missed it? No problem!

Replays of all our past episodes are always available in the episode archives.