Our first setup of the day is the $18.4B department store operator, Dick's Sporting Goods $DKS:

The Vice Chairman, William Colombo reported an acquisition of 40,000 DKS shares, equivalent to $8.5 million in March.

DKS has been in a structural uptrend since it broke out of a big base in early 2021.

As you can see, DKS is working on resolving higher from a tight coil as it flirts with fresh all-time highs.

We want to get long against the 423.6% Fibonacci extension around 224, with a target of 354 over the coming 3-6 months.

Our following setup is the $4.8B telehealth platform provider, Hims & Hers Health $HIMS:

Last month, director Christopher Payne revealed a purchase of $1.9 million.

HIMS is currently testing a critical resistance zone at its old highs from three years ago.

While it is reasonable to expect some digestion at such a big level, we feel the bias for this leader points firmly to the upside for the foreseeable future.

Our line in the sand lies at 25.25. Above there, and we have to be long this momentum leader. We're targeting 39 over the coming 2-4 months.

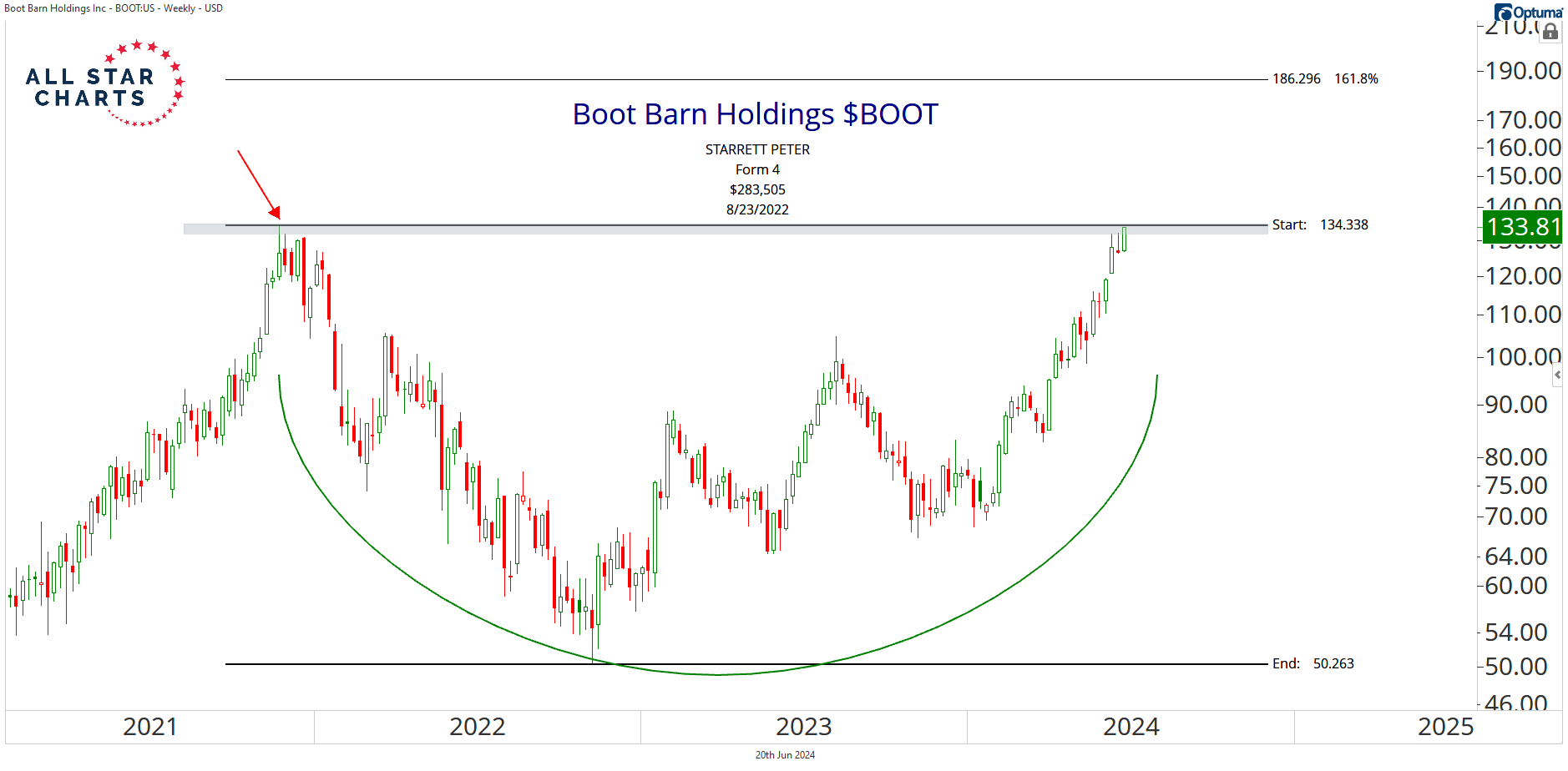

Here’s Boot Barn Holdings $BOOT, a $3.9B retail chain:

In the summer of 2022, director Peter Starrett bought 4,000 shares, equivalent to $283,505.

Since then, the stock has risen roughly 40%, reaching its prior cycle highs from 2021 in the process.

Although buyers now have to deal with this overhead supply, we believe this leader eventually breaks higher.

For this reason, we only want to be long on strength above 135, with a 3-6 month target of 186.

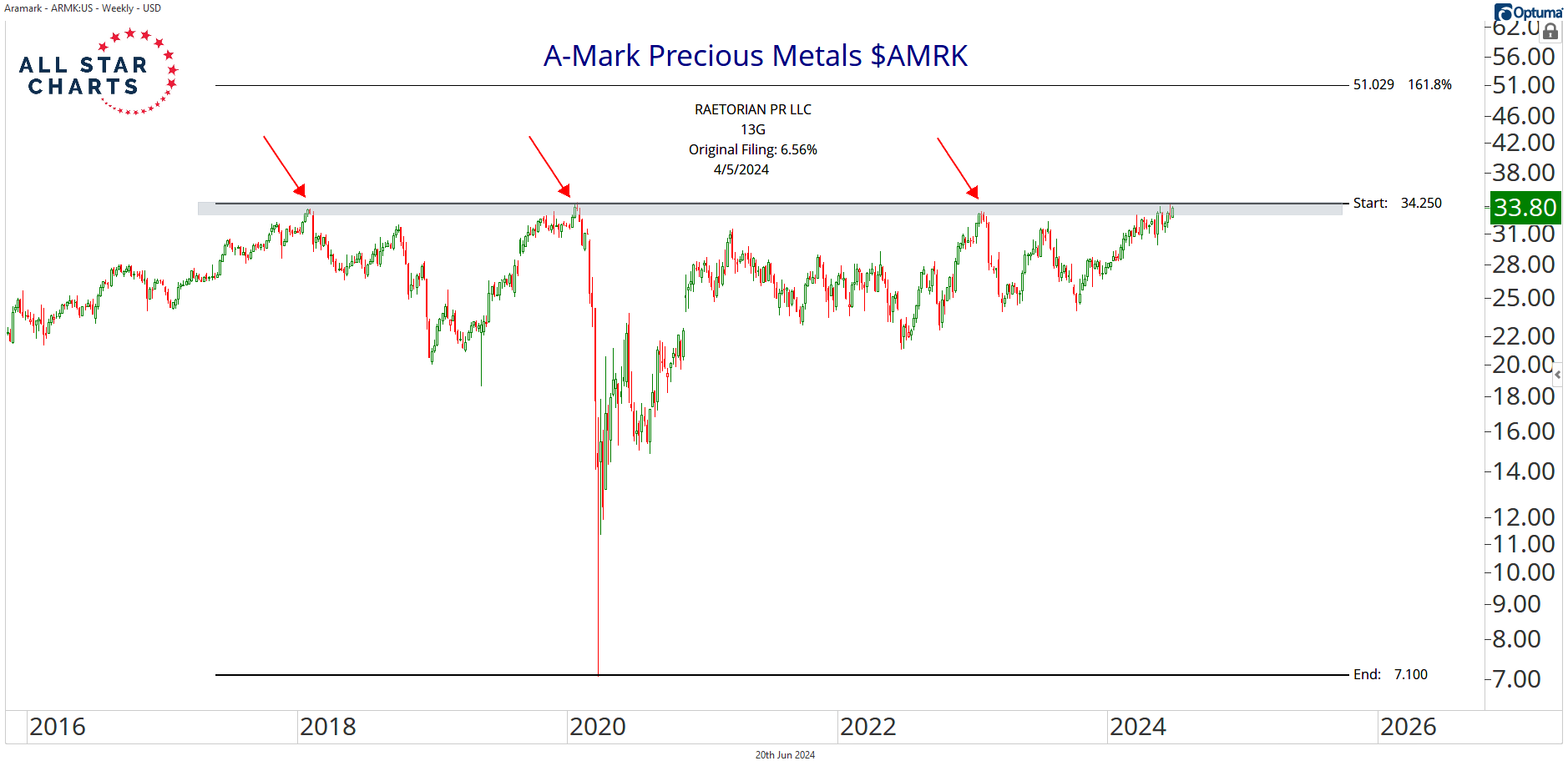

Next, we have Aramark $ARMK:

Mantle Ridge LP filed a 13G in August of 2022 revealing an initial stake of 10%.

The stock looks poised to resolve higher from a six-year consolidation as it presses through a shelf of former highs.

This level has acted as resistance in the past, making it a great place to define our risk and get long on a breakout.

If and when that happens, we want to be long ARMK above 34.25 with a target of 51 over the coming 3-6 months.

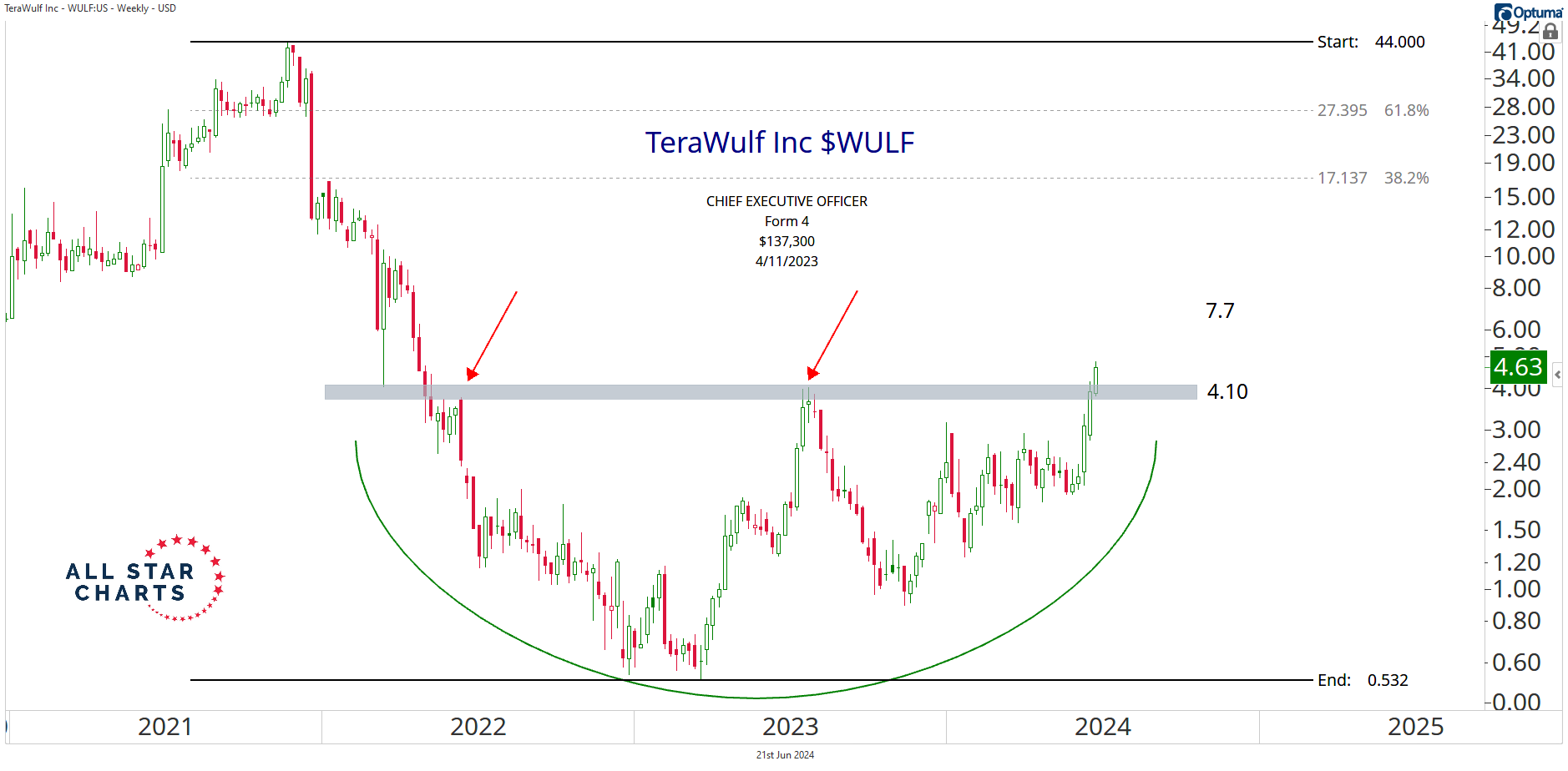

Last but not least, we have the $1.5B crypto miner, TeraWulf Inc $WULF:

Last year, the Co-Founder and CEO Paul Prager revealed a purchase of $137,300.

This insider buy came on the heels of a roughly 98% drawdown from its peak in 2021, which really stood out at the time.

After spending the last few years carving out a rounding bottom formation, the stock has experienced incredible momentum in recent weeks, surging through the upper bounds of the base.

If we’re above 4.10, our bet is that a structural trend reversal is underway in WULF.

We’re targeting 7.70 over the next 2-4 months, with a secondary target of 17.50.

If this trend reversal remains valid, we’re looking for the stock to keep climbing the right-hand side of this base back toward the prior-cycle highs. But, let’s take it one step at a time. We’ll be sure to talk more about this one along the way.

Have a great weekend everyone!