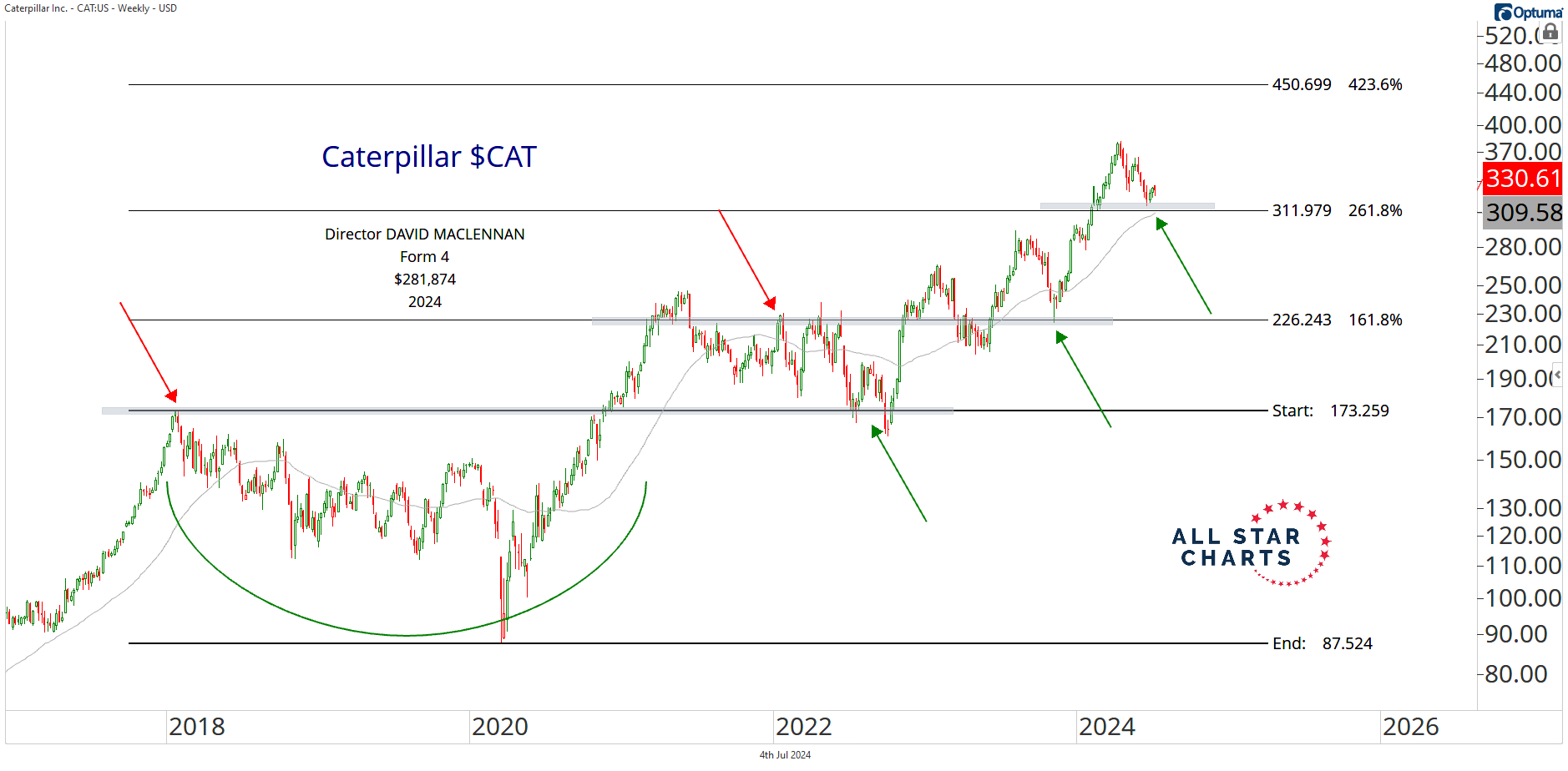

Our first setup of the day is the $161B industrial bellwether, Caterpillar $CAT:

Director David MacLennan has begun to build a position, making purchases in February and May of this year totaling $281,874.

CAT has been stair-stepping higher and consolidating constructively along the way since a huge base-breakout in 2020.

This year, price exceeded a key extension level that now became support with our next target near 450.

We only want to be long if we're above 312. Below that level things get hairy.

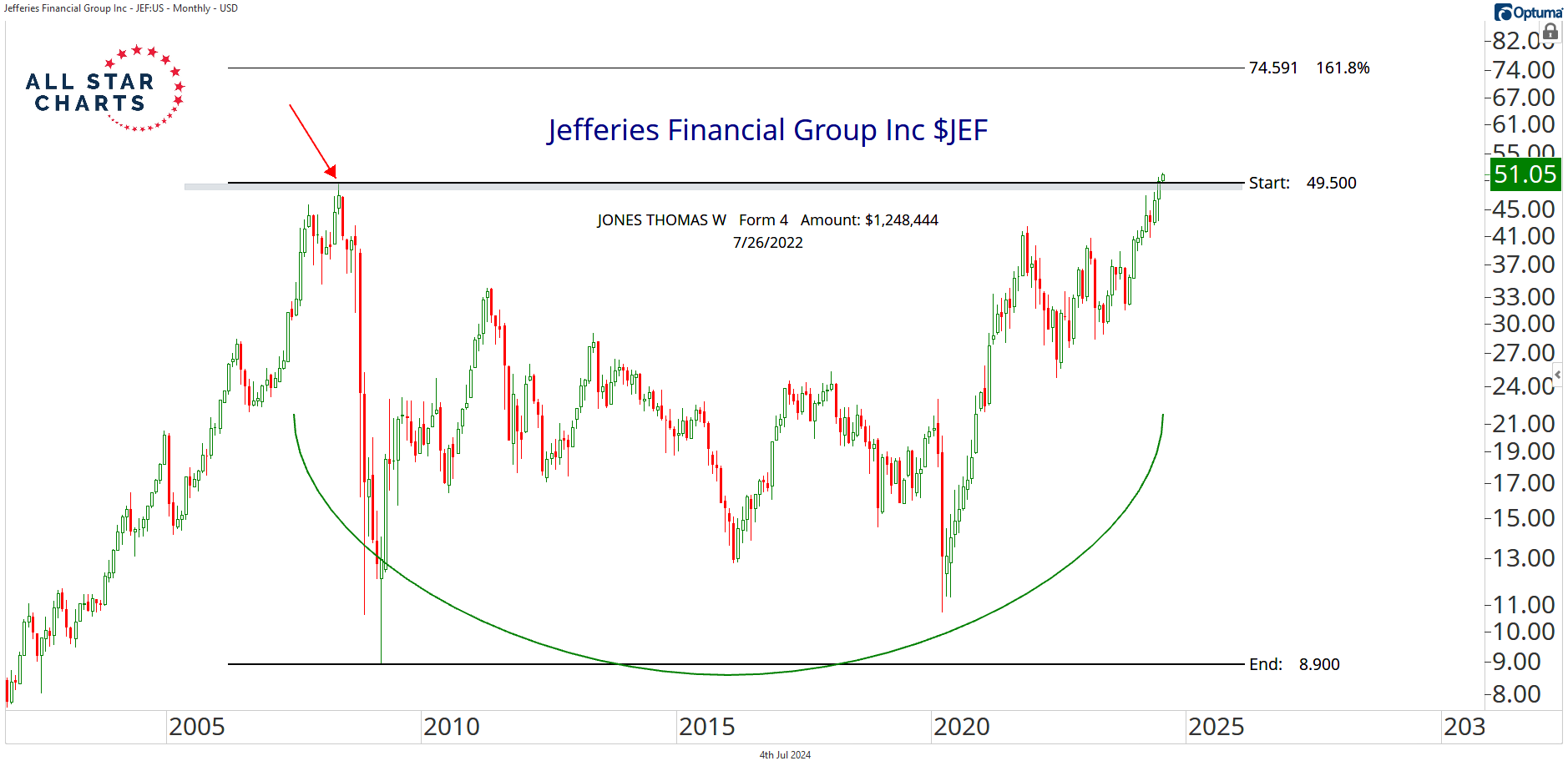

Next, we have a $10.8B investment bank, Jefferies Financial Group $JEF:

In July 2022, director Thomas Wade Jones revealed an acquisition of 40,000 shares, equivalent to $1.2 million.

JEF is knocking on the door to new all-time highs.

Buyers are working on absorbing all the overhead supply at the upper bounds of a decade-long base.

If we’re above 49.50, we want to own it, with a target of 74.50 over the coming 3-6 months.

Next, we have the $252B software company, Adobe $ADBE:

Last month, Sen. Tuberville reported an acquisition worth between $15,000 and $50,000.

The path of least resistance is higher for ADBE if it holds the 536 level. We're targeting 699 in the coming 1-3 months.

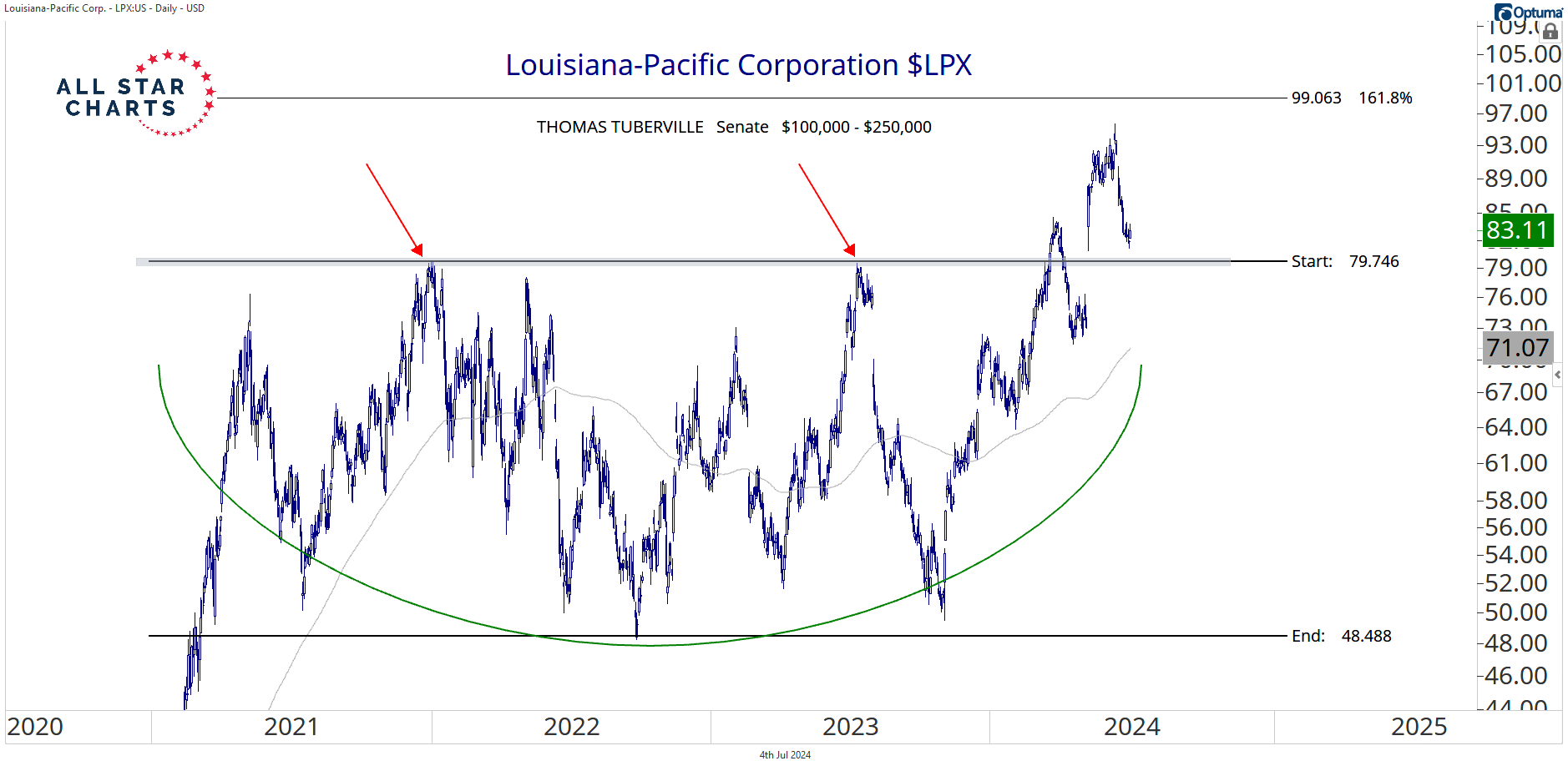

Last but not least, we have Louisiana-Pacific Corp $LPX:

Tuberville disclosed a periodic transaction report showing a purchase between $100,000 and $250,000 in October last year.

After emerging higher from a three-year base, price has pulled back to the breakout level.

Now, all that former resistance has turned into a logical level of support.

If we’re above 80, we want to be long LPX with a target of 99 over the next 2-4 months.

However, any breach below 80 would mean we’re early or wrong, and we do not want to be involved.

Have a great week everyone!