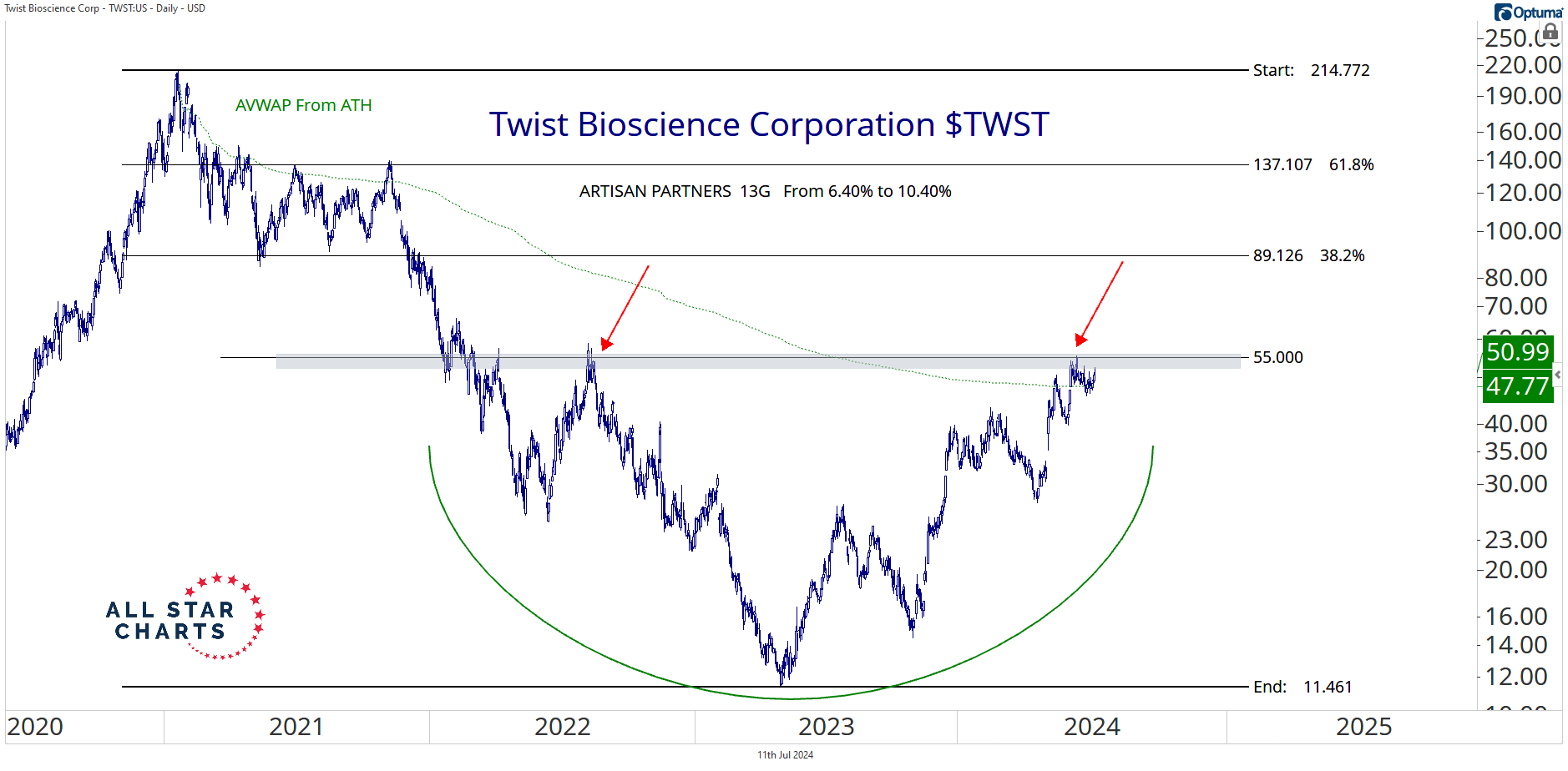

Our first setup of the day is a $3B biotech company, Twist Bioscience Corporation $TWST:

Three days ago, Artisan Partners announced an increase in ownership from 6.40% to 10.40%.

TWST is pressing against the upper bounds of a multi-year basing pattern as it absorbs a shelf of overhead supply.

If we’re above 55, we want to own it, with a target of 89 over the coming 2-4 months. Over longer timeframes, we’re targeting 137 and 215.

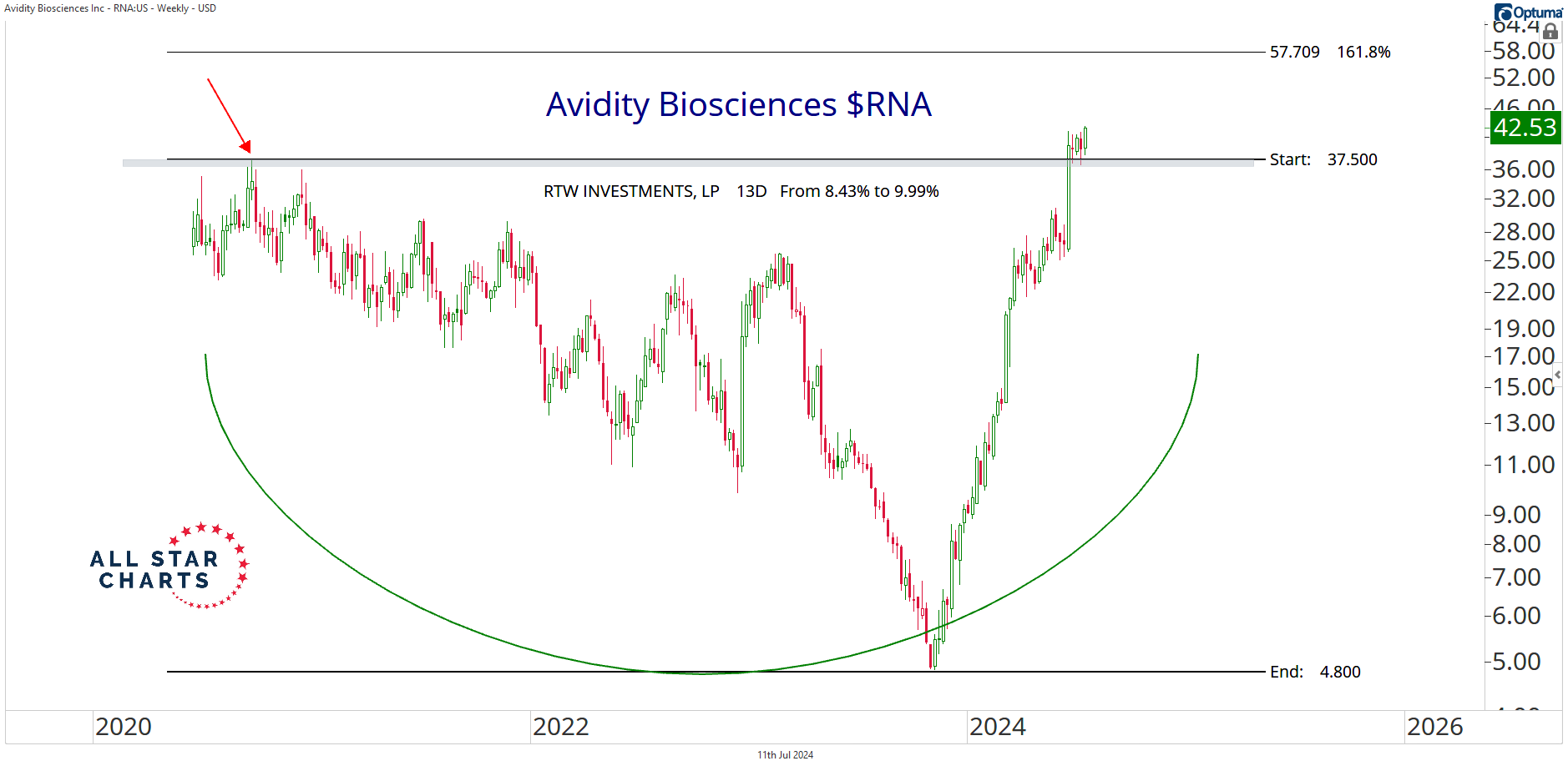

Here’s Avidity Biosciences Inc $RNA:

In March, RTW Investments LP filed a 13D reporting an increase in ownership of 1.47%.

RNA has put the finishing touches on a multi-year basing pattern and is printing fresh all-time highs.

If we’re above 37.50, we want to own, with a target of 57.75 over the coming 2-4 months.

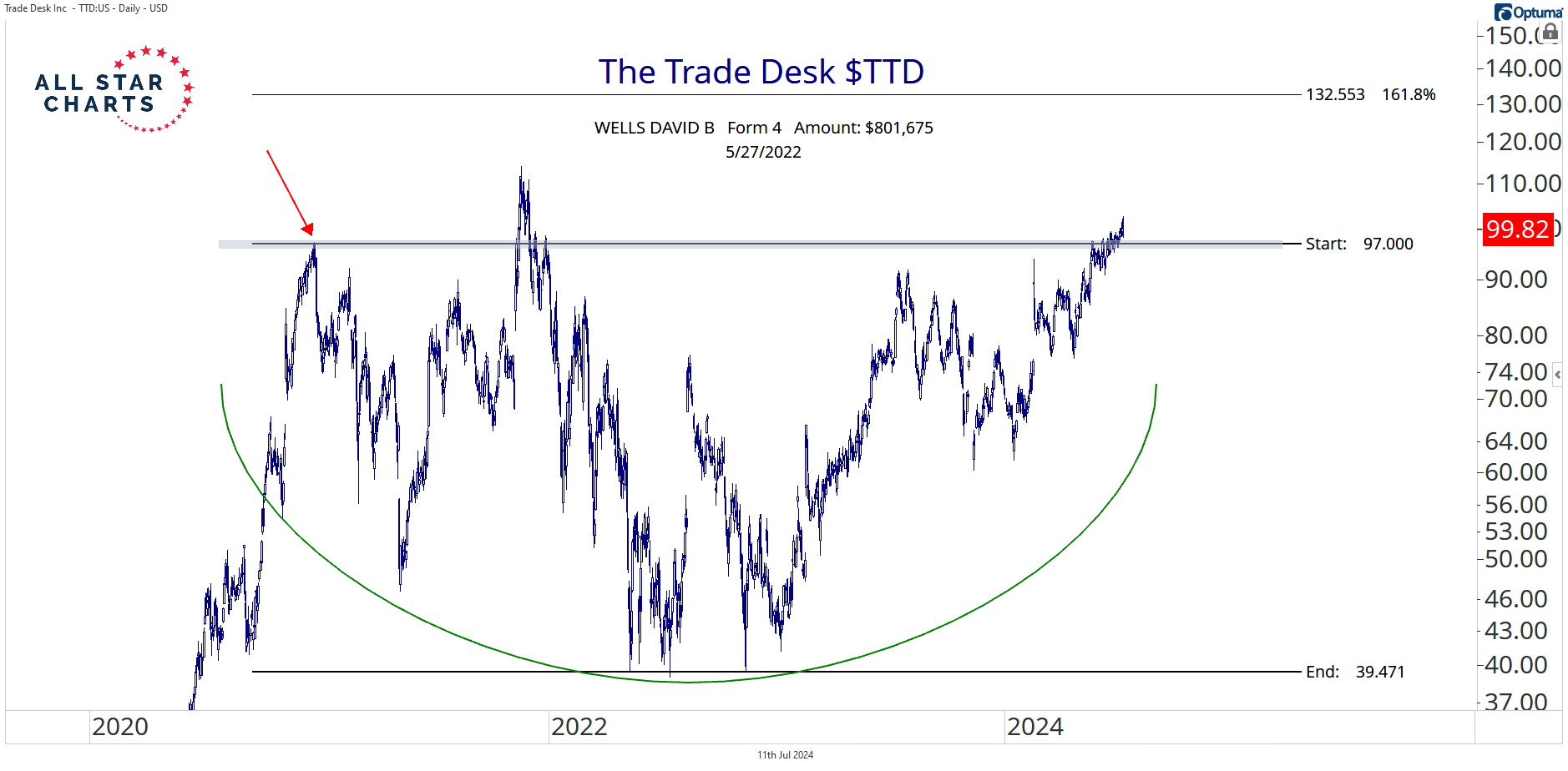

Our following setup is The Trade Desk Inc $TTD:

In May 2022, director David B. Wells bought 17,500 shares for a total amount of $801,675.

If TTD holds above 97, the path of least resistance is higher. We’re targeting 132.50 over the coming 3-6 months.

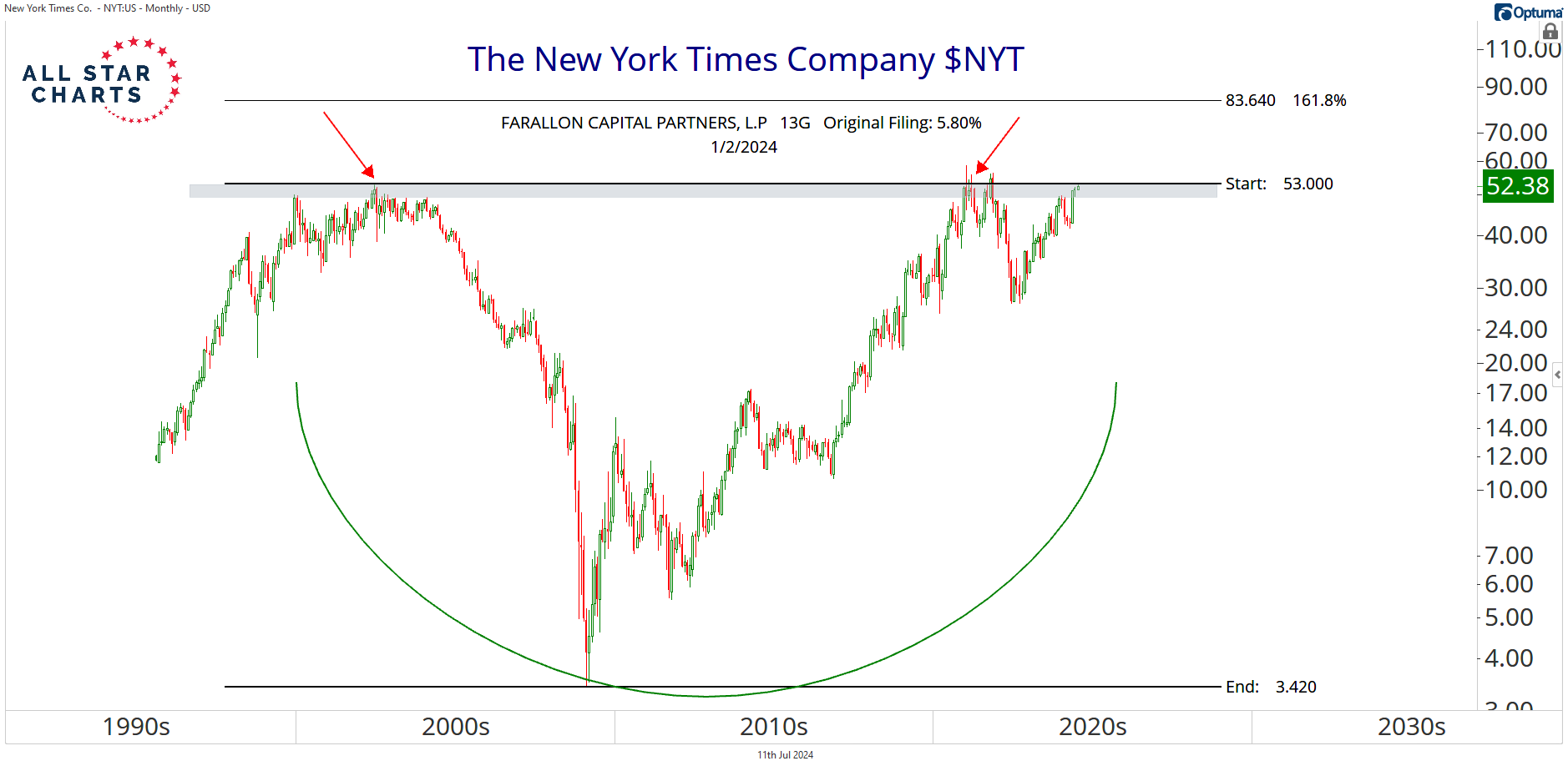

Now, we have the well-known mass-media company, The New York Times Co. $NYT:

Earlier this year, Farallon Capital Management disclosed an original 13G filing for a 5.80% ownership.

NYT is knocking on the door to new all-time highs.

Buyers are working on absorbing all the overhead supply at the upper bounds of a decade-long base.

If we’re above 53, we want to own it, with a target of 83.50 over the coming 3-6 months.

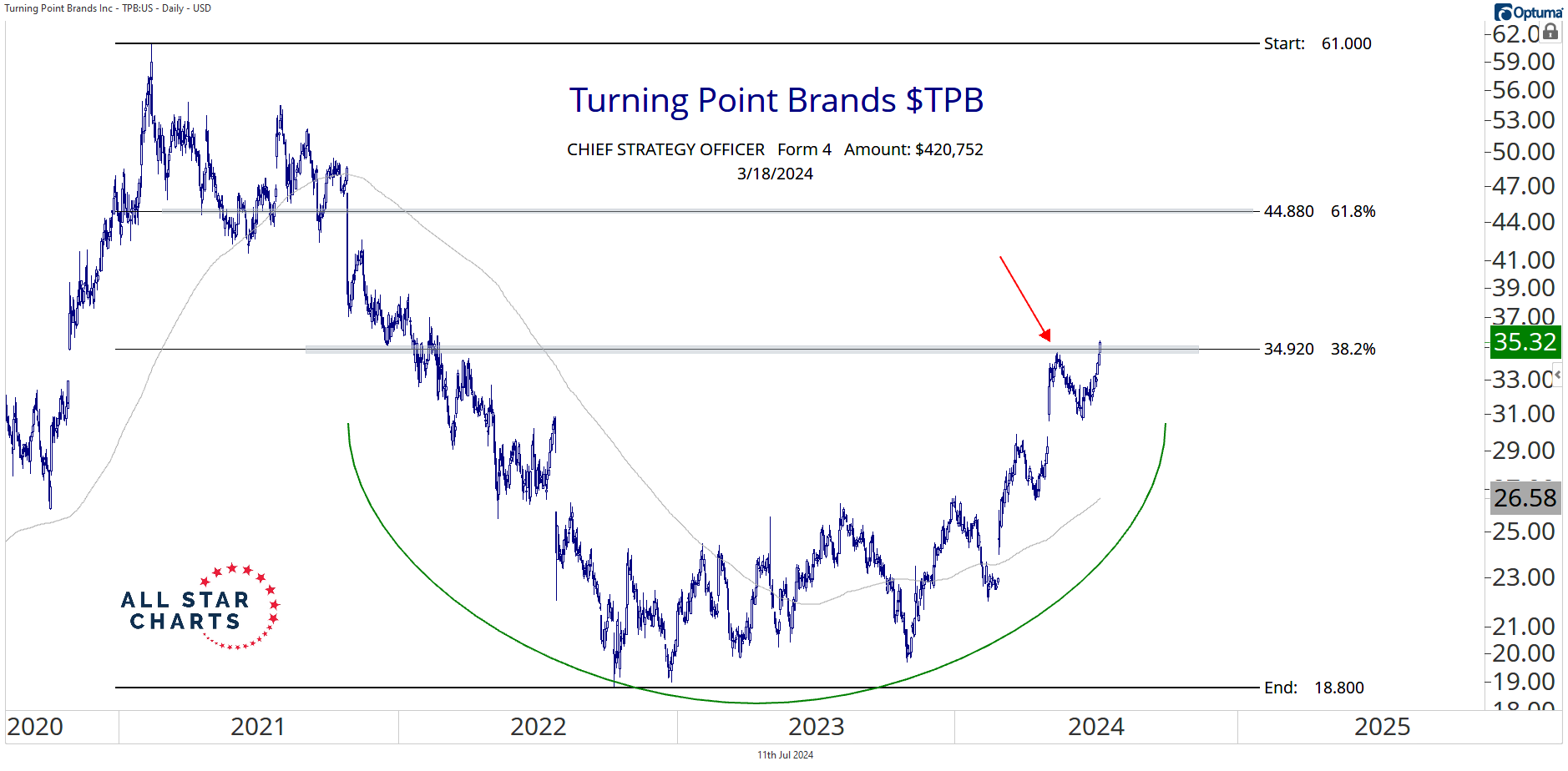

Here’s Turning Point Brands Inc $TPB:

In mid-March, the chief strategy officer revealed a purchase of $420,752.

The stock has been carving out a massive bearish-to-bullish reversal pattern for the past two and a half years.

TPB is reclaiming the 38.2% retracement of the prior drawdown as it continues to print new 52-week highs.

We like it long above 35, with a target of 45 over the coming 2-4 months. Over longer timeframes, we’re looking at a secondary objective of the former all-time high around 61.

Our next setup is a $8.6B multinational corporation focused on educational publishing and services, Pearson PLC $PSO:

In late 2022, Cevian Capital increased its active stake from 8.37% to 11.84%.

Pearson is on the verge of completing a multi-year rounding bottom formation. That shelf of former highs from 2016 and 2018 marks a significant level of overhead supply.

We think it’s only a matter of time until it resolves higher as bulls continue to chip away at this crucial level.

As long as it’s above 13, we want to be long with a target of 15 over the next 1-3 months and a secondary objective of 22.50 over longer timeframes.

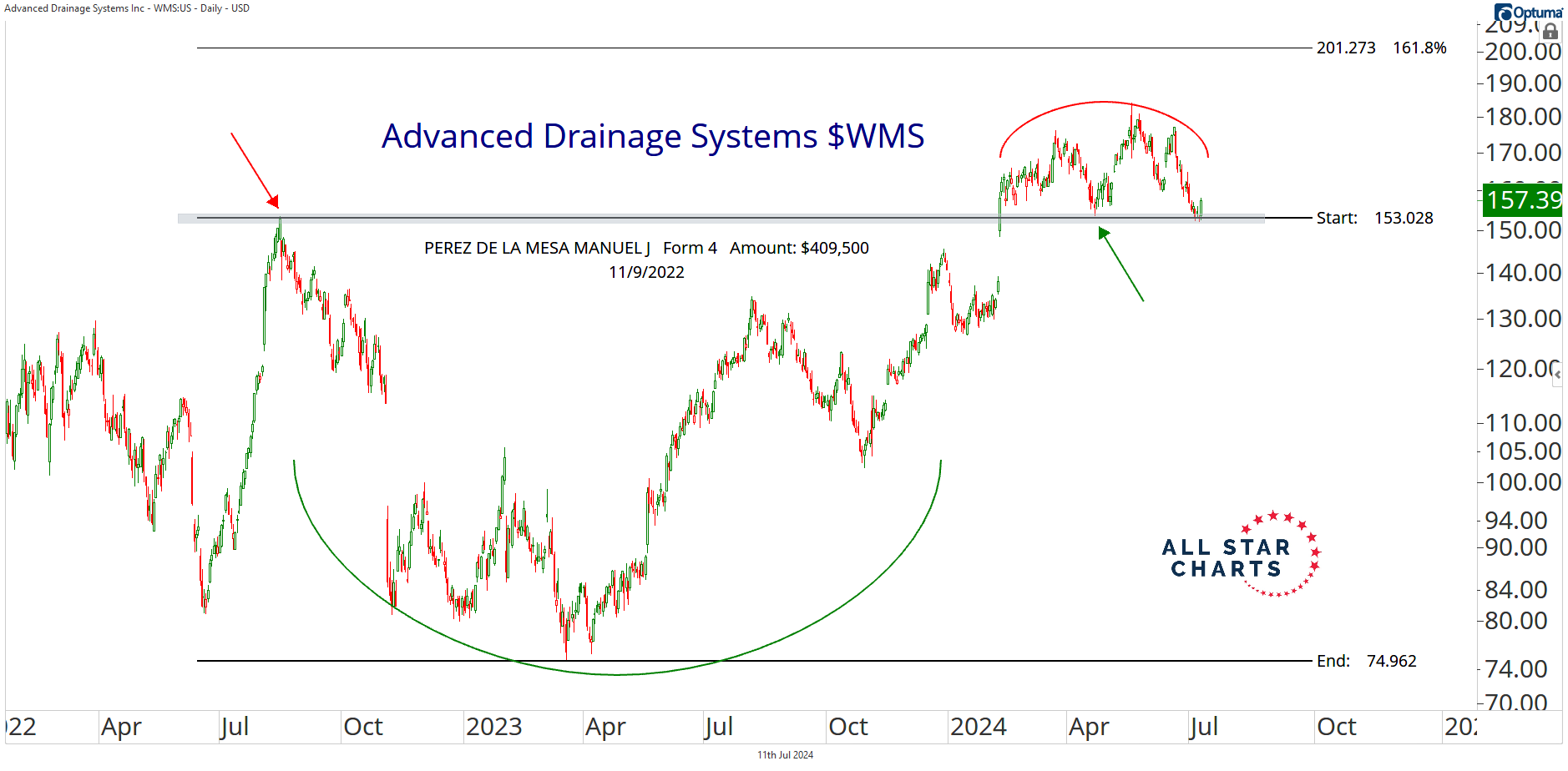

Here’s Advanced Drainage Systems Inc. $WMS:

In November 2022, Director Manuel J. Perez de la Mesa revealed a position worth $409,500.

After completing a multi-month base in February, WMS pulled back to the breakout level at a shelf of former highs.

As you can see in the chart, buyers are stepping in to defend this area of former resistance, which has now become support.

If the price is above 153, we want to bet on a fresh leg higher. We're buyers with a target of 201 over the coming 2-4 months.

Next, we have Warrior Met Coal Inc. $HCC:

In February, Alan H Schumacher, director of the company, reported a small purchase.

HCC has enjoyed a nice run since last summer and is currently halting its advance at the 261.8% extension level.

While some consolidation here would be welcome, we anticipate that HCC will continue its path higher in the direction of the underlying trend.

We want to be long only if and when we break out above 72.50, with a 3-6 month target.

Last but not least, we have another coal company, Alliance Resource Partners $ARLP:

Last year, the president and CEO revealed a purchase of $2.7 million in its latest Form 4.

ARLP has traded in a well-defined range for the past two years as buyers absorb overhead supply at a critical resistance area.

We think it's only a matter of time before they take control and force an upside resolution.

We only want to be long on strength above 26 with a target of 41 in the coming 3-6 months.

Have a great weekend, everyone!