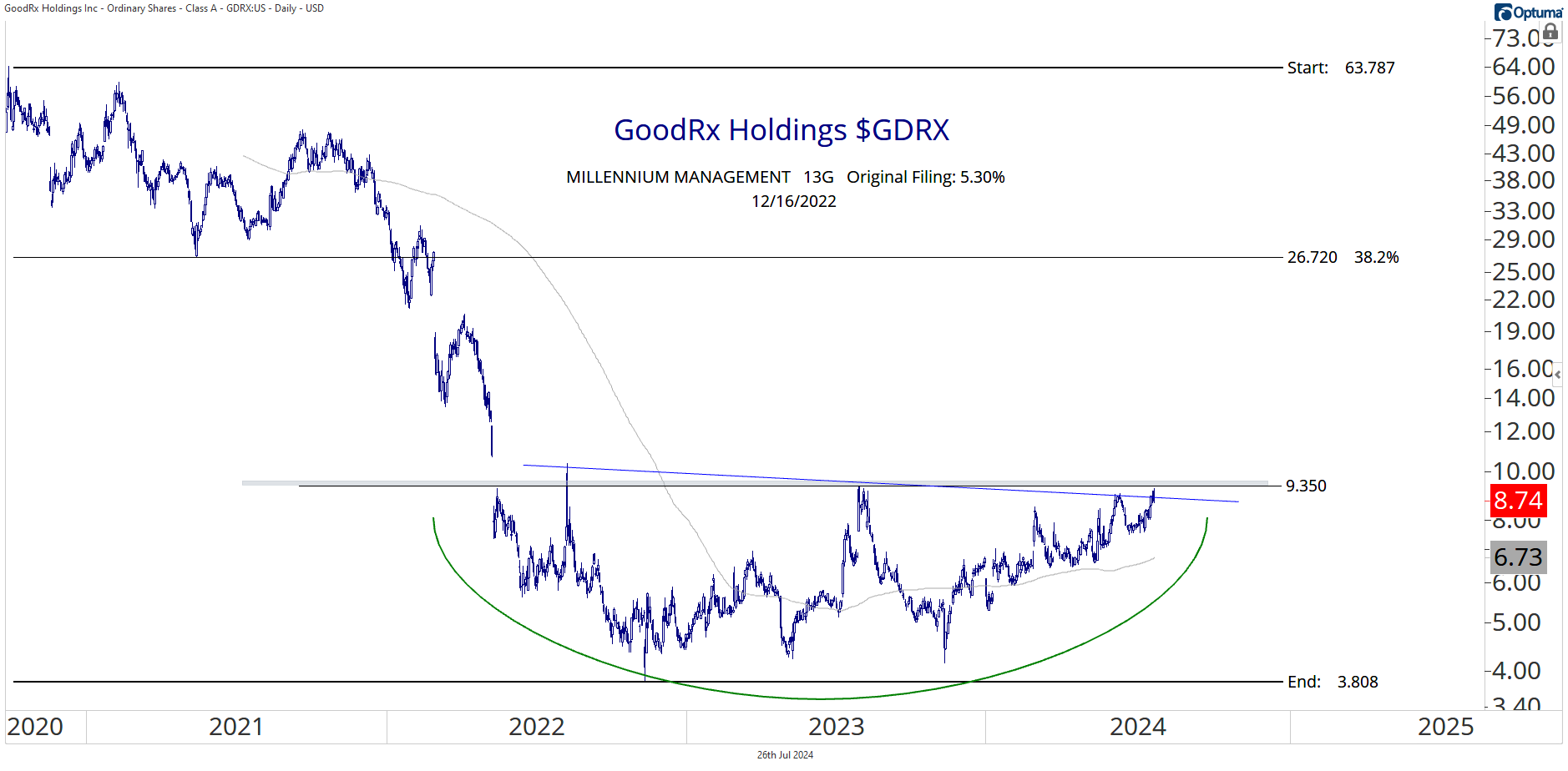

First up is the digital prescription drug platform, GoodRx $GDRX:

In December 2022, Millennium Management LLC filed a 13G revealing an initial stake of 5.30%.

GoodRx collapsed by over 90% after going public in late 2020. The stock has been carving out a multi-year bearish-to-bullish reversal pattern and looks poised to resolve higher in the coming days to weeks.

We want to buy GDRX on strength above 9.35, with a target of 26.75 over the coming 6-12 months.

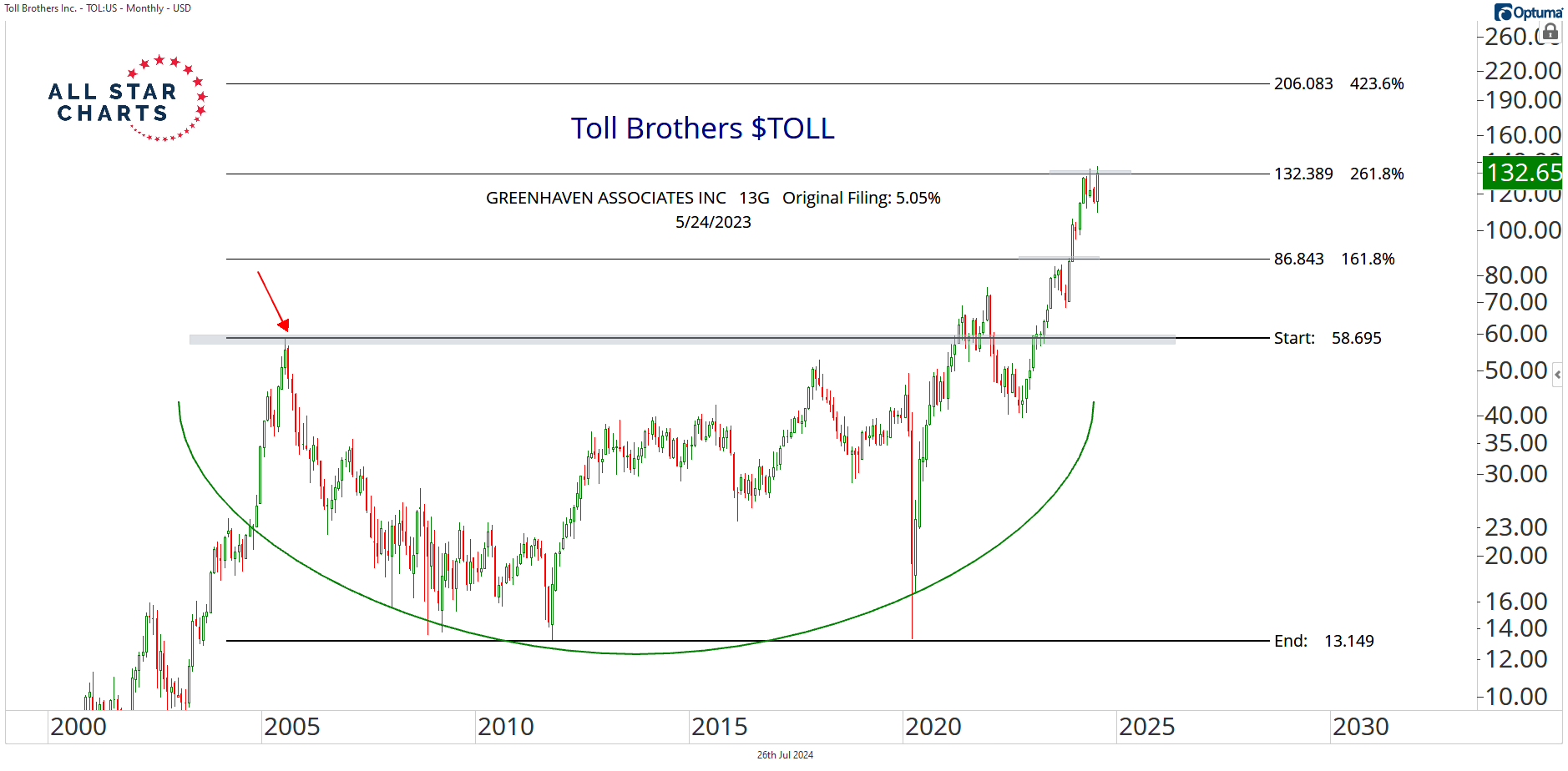

Next, we have the luxury homebuilder, Toll Brothers $TOLL:

In May last year, Greenhaven Associates filed a 13G revealing an initial stake of 5.05%.

After finishing a multi-decade basing pattern, Toll Brothers has screamed higher to its second extension level and shows no signs of slowing down.

We want to own TOL if it’s above 132, with a target of 206 over the coming 3-6 months.

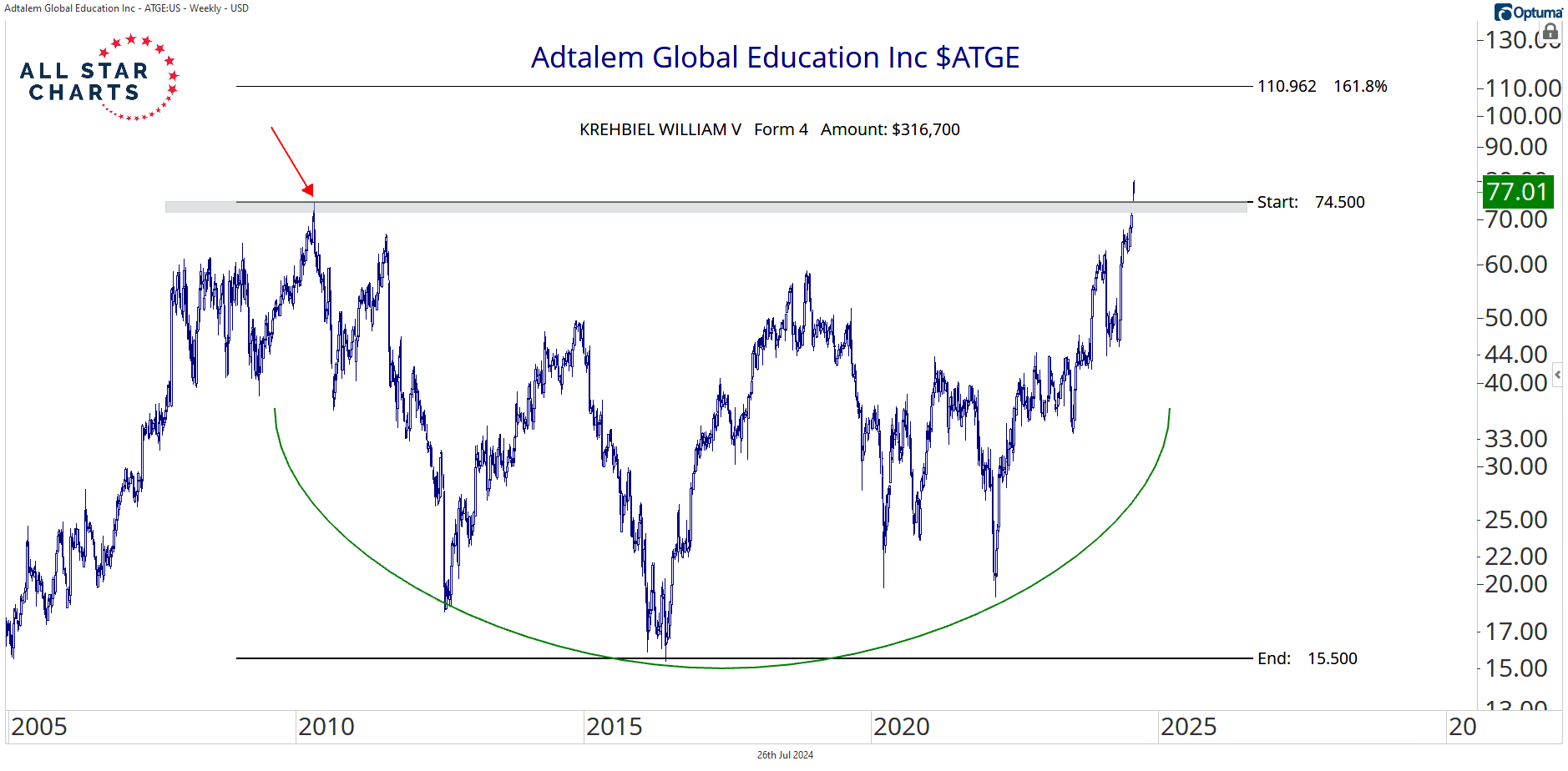

Here’s Adtalem Global Education $ATGE, a company providing a wide range of educational programs and services:

Two years ago, director William V Krehbiel disclosed a Form 4 reporting a purchase of $316,700.

Adtalem Global Education is trading at its highest level in history after putting the finishing touches on a multi-decade base.

We want to own ATGE if it’s above 74.50, with a target of 111 over the coming 3-6 months.

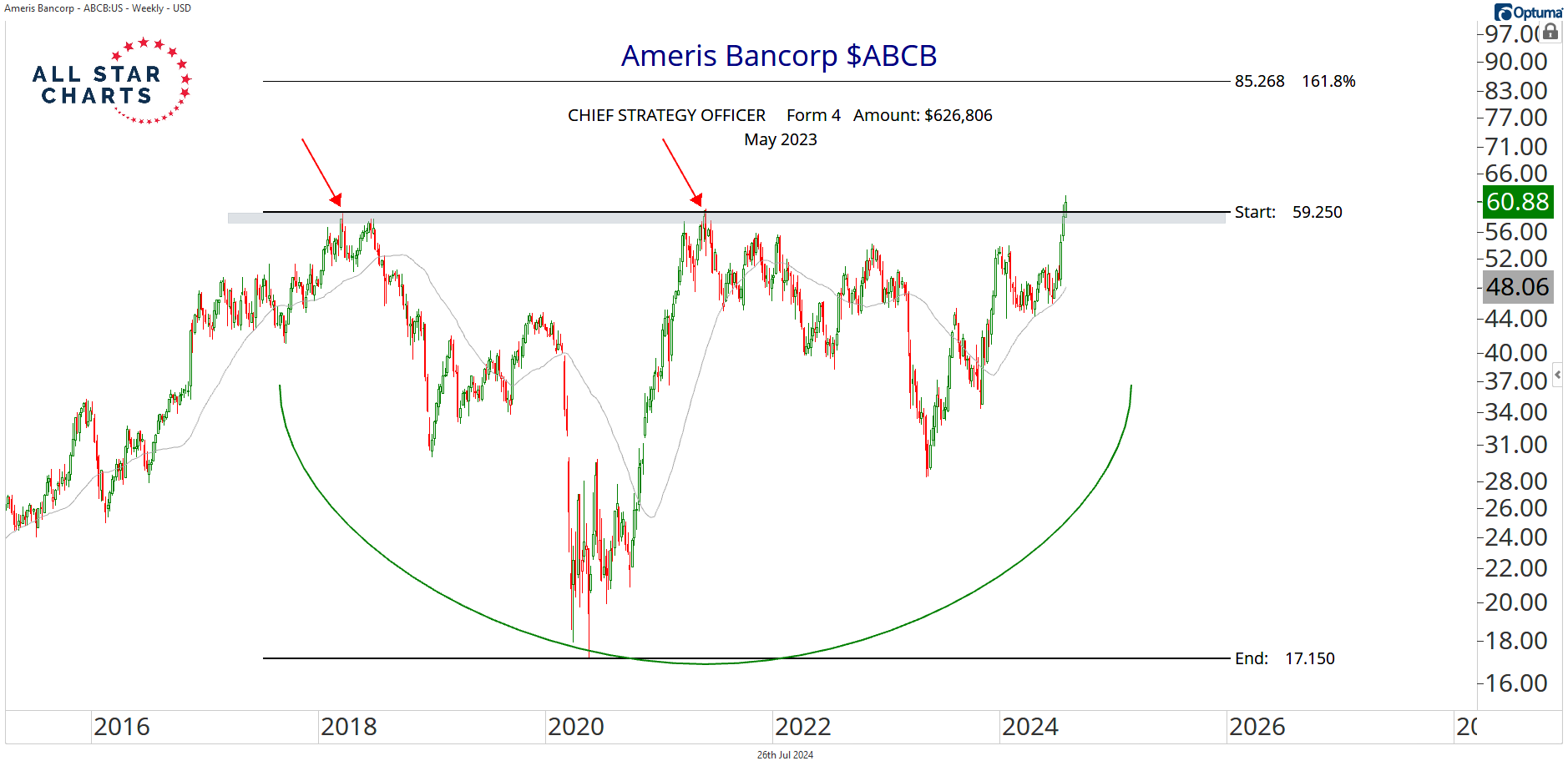

Our next setup is the retail and institutional bank from Georgia, Ameris Bancorp $ABCB:

In May 2023, the chief strategy officer revealed a position worth $626,806.

Ameris Bancorp has completed a textbook accumulation pattern and is printing fresh all-time highs. With the path of least resistance pointing higher, we want to own ABCB as long as this breakout is valid.

We’re long ABCB above 59.25, targeting 85.25 over the coming 3-6 months.

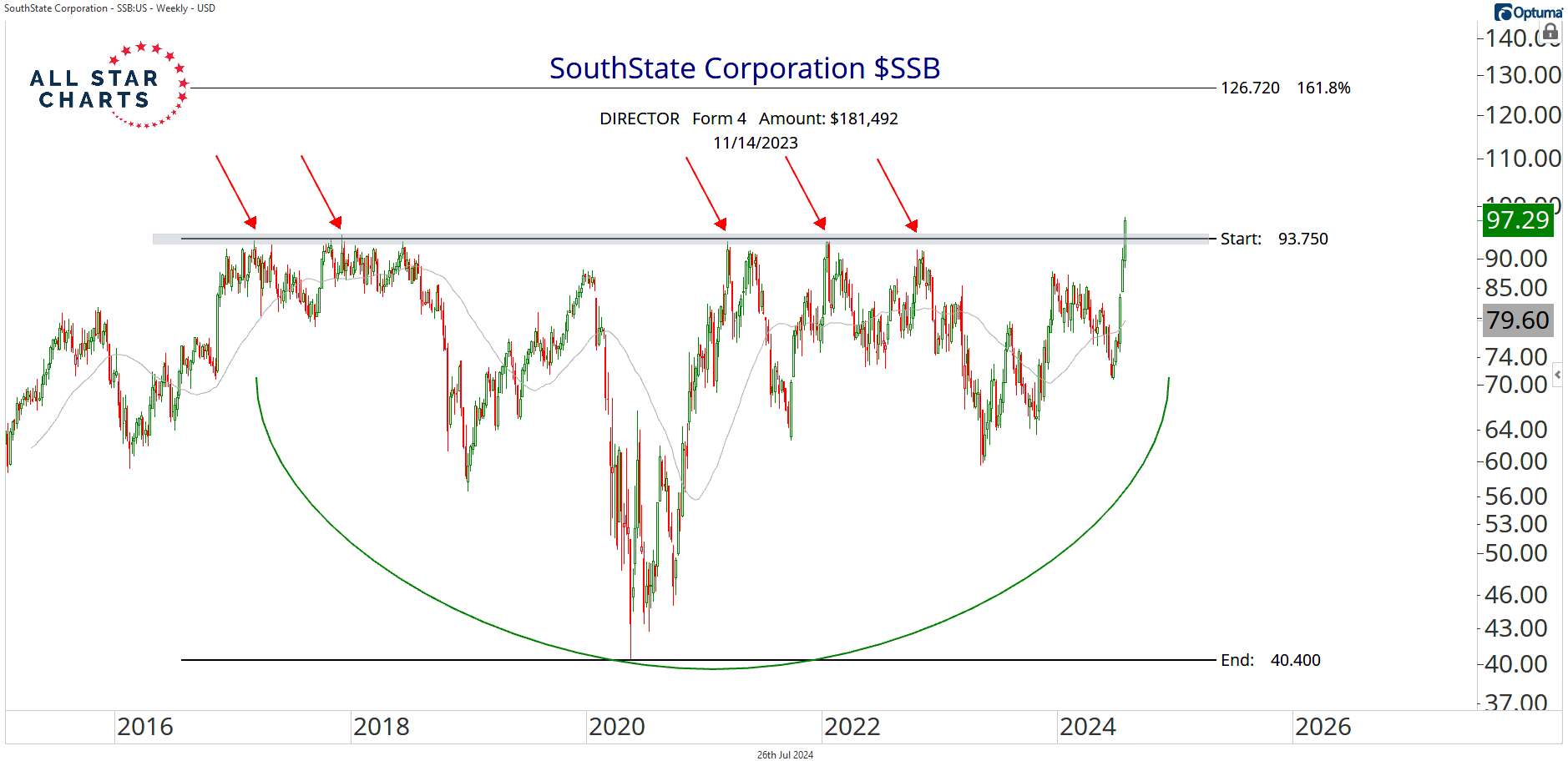

Next, we have SouthState Corp $SSB, a company providing financial services across the Southeastern United States:

In November, one director of the company filed a Form 4 revealing a purchase of $181,492.

SouthState is pressing against a shelf of former highs as it looks poised to complete a massive consolidation pattern.

We want to own SSB if it’s above 93.75, with a target of 126.75 over the coming 2-4 months.

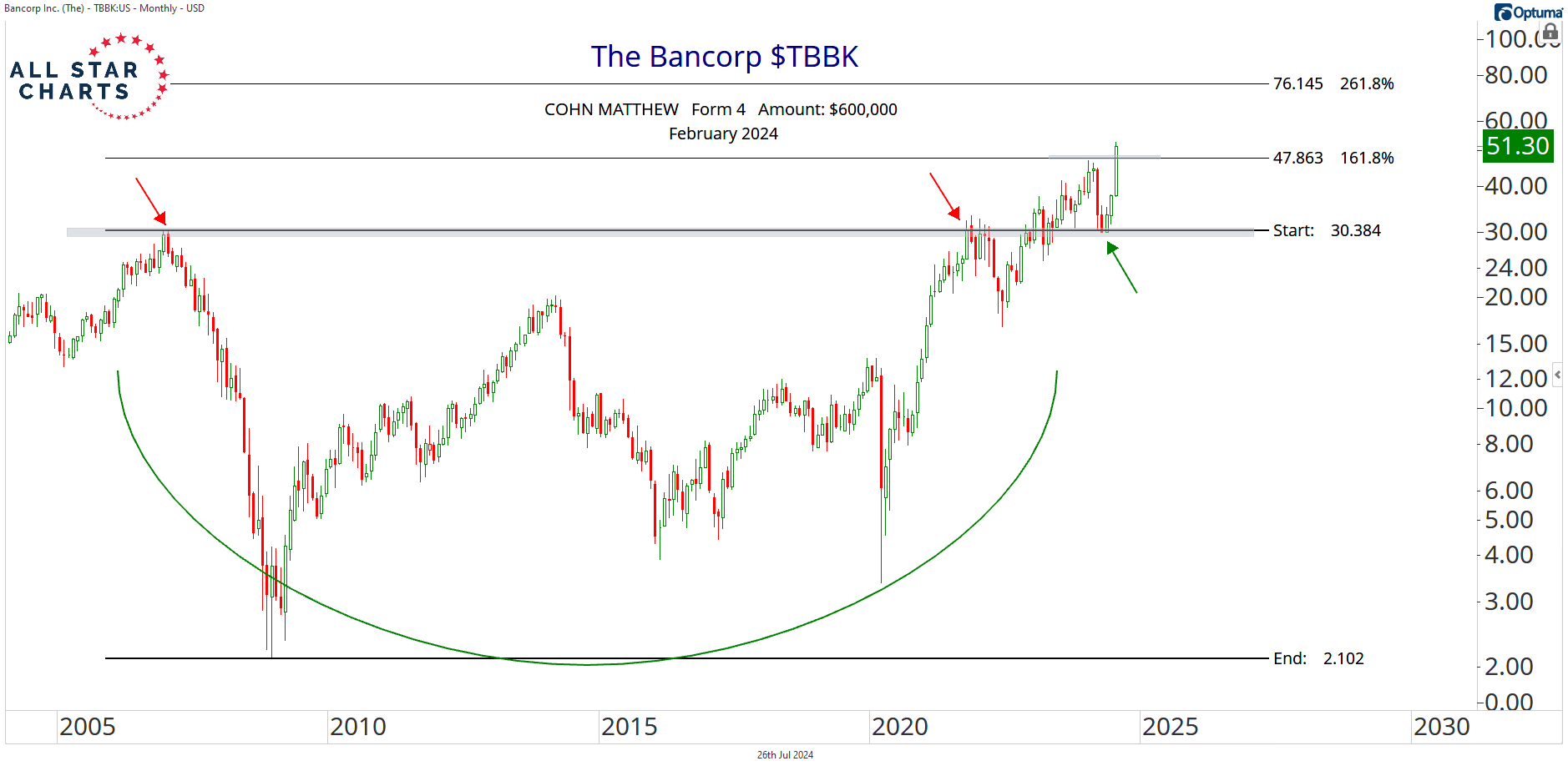

Here’s The Bancorp $TBBK, a company providing various financial services across the United States:

In February, director Matthew Cohn made two purchases worth roughly $600,000.

The Bancorp is making new all-time highs as it decisively clears a key extension level from a multi-decade basing pattern.

We want to own TBBK if it’s above 48, with a target of 76 over the coming 3-6 months.

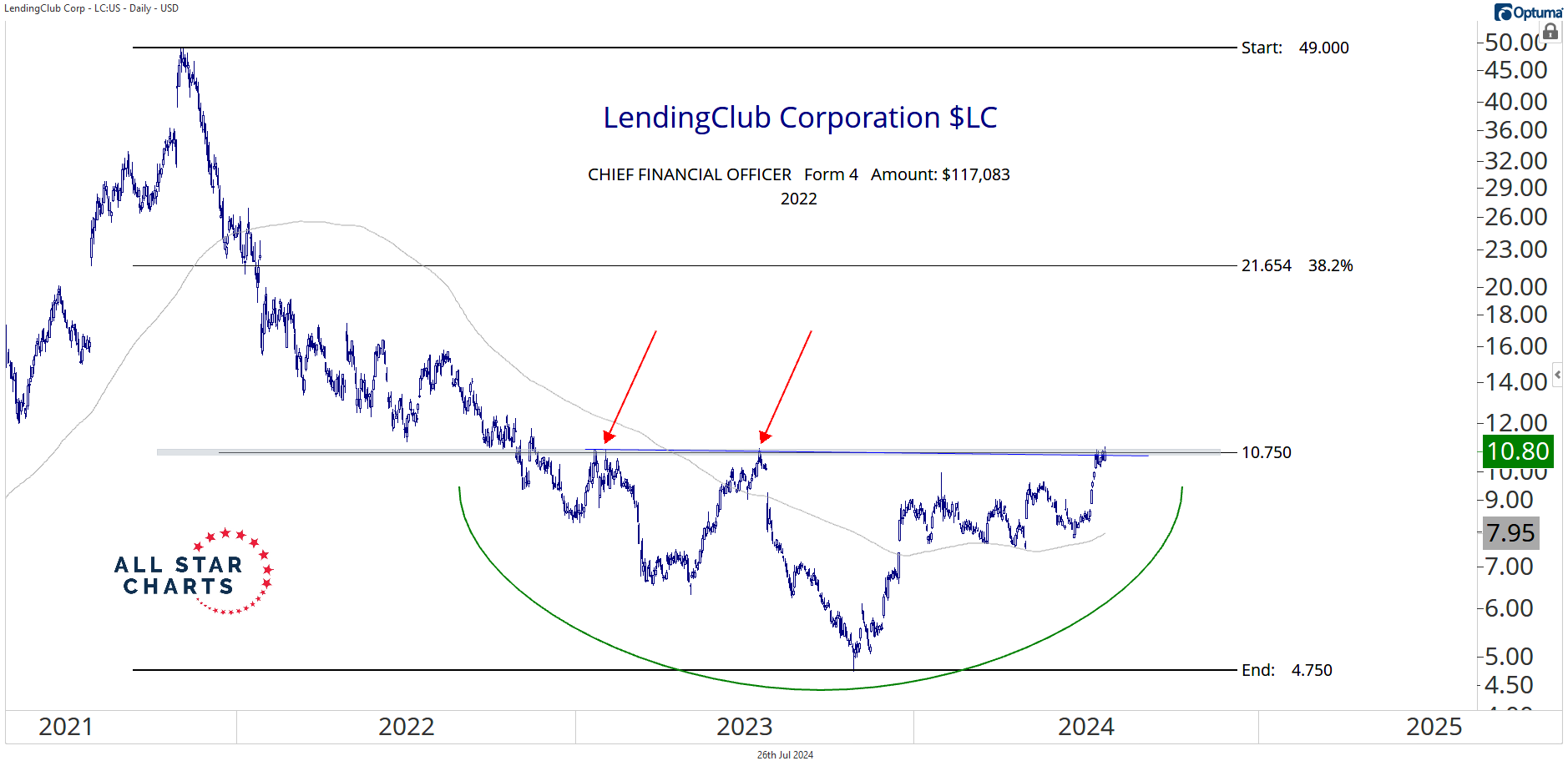

Next up is LendingClub $LC, an online peer-to-peer lending platform:

Back in 2022, the CFO revealed a small purchase of $117,083.

LendingClub collapsed by over 90% after peaking in late 2021. The stock has been carving out a multi-year bearish-to-bullish reversal pattern and looks poised to resolve higher in the coming days and weeks.

If and when we get a decisive breakout, we want to be involved.

We want to buy LC on strength above 10.75, with a target of 21.50 over the coming 3-6 months. Over longer timeframes, we’re looking at a secondary objective of 49.

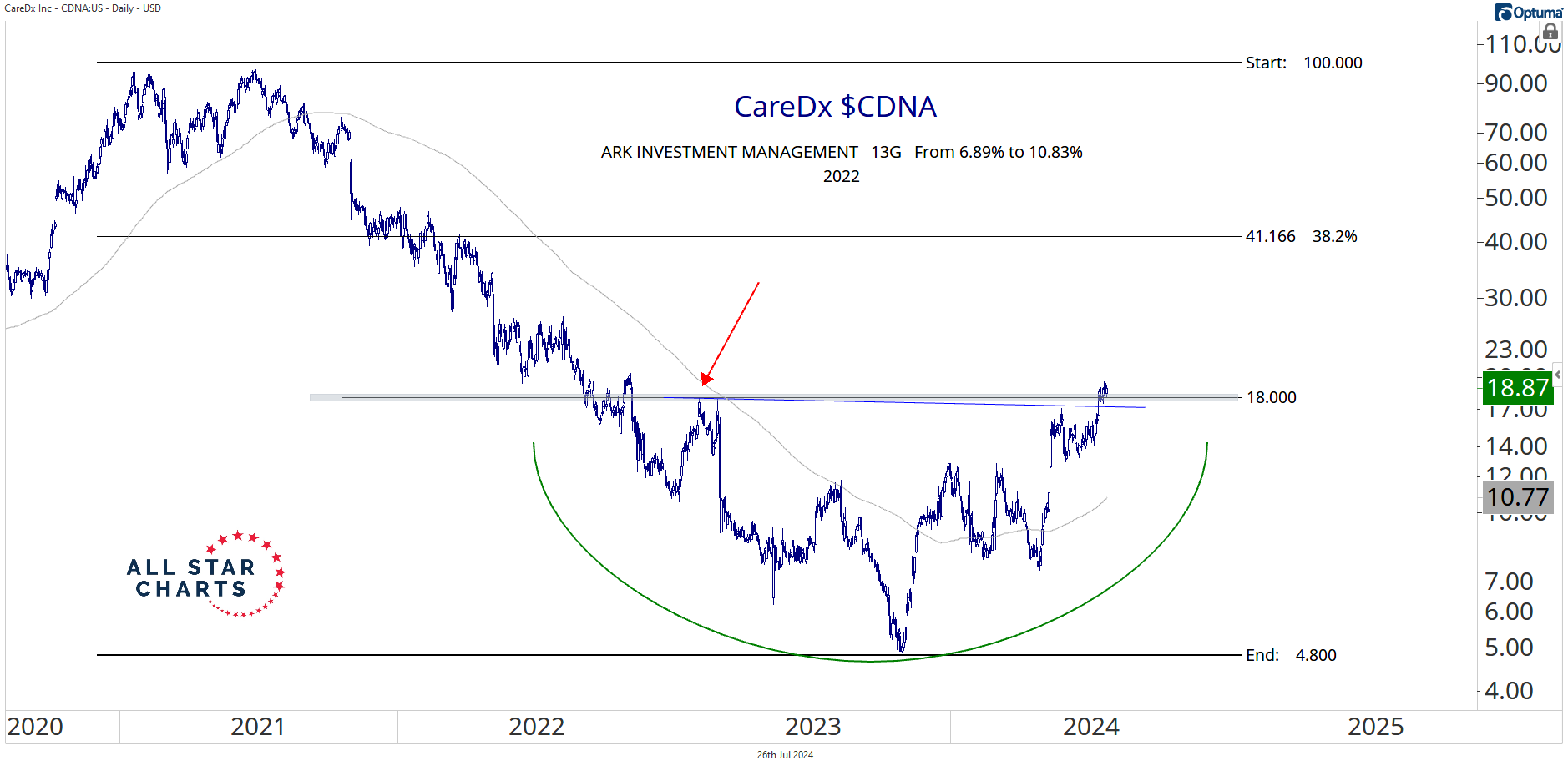

Our next setup is CareDx, a biotech company that’s developing diagnostic solutions for transplant patients:

In November 2022, ARK Investment Management filed a 13G revealing an increase in ownership from 6.89% to 10.83%.

CareDx is putting the finishing touches on a multi-year bearish-to-bullish trend reversal and is making new 52-week highs.

We want to own CDNA if it’s above 18, with a target of 41 over the coming 3-6 months. Over longer timeframes, we’re looking at a secondary objective at the former all-time high near 100, but we’ll be sure to follow up when the time comes.

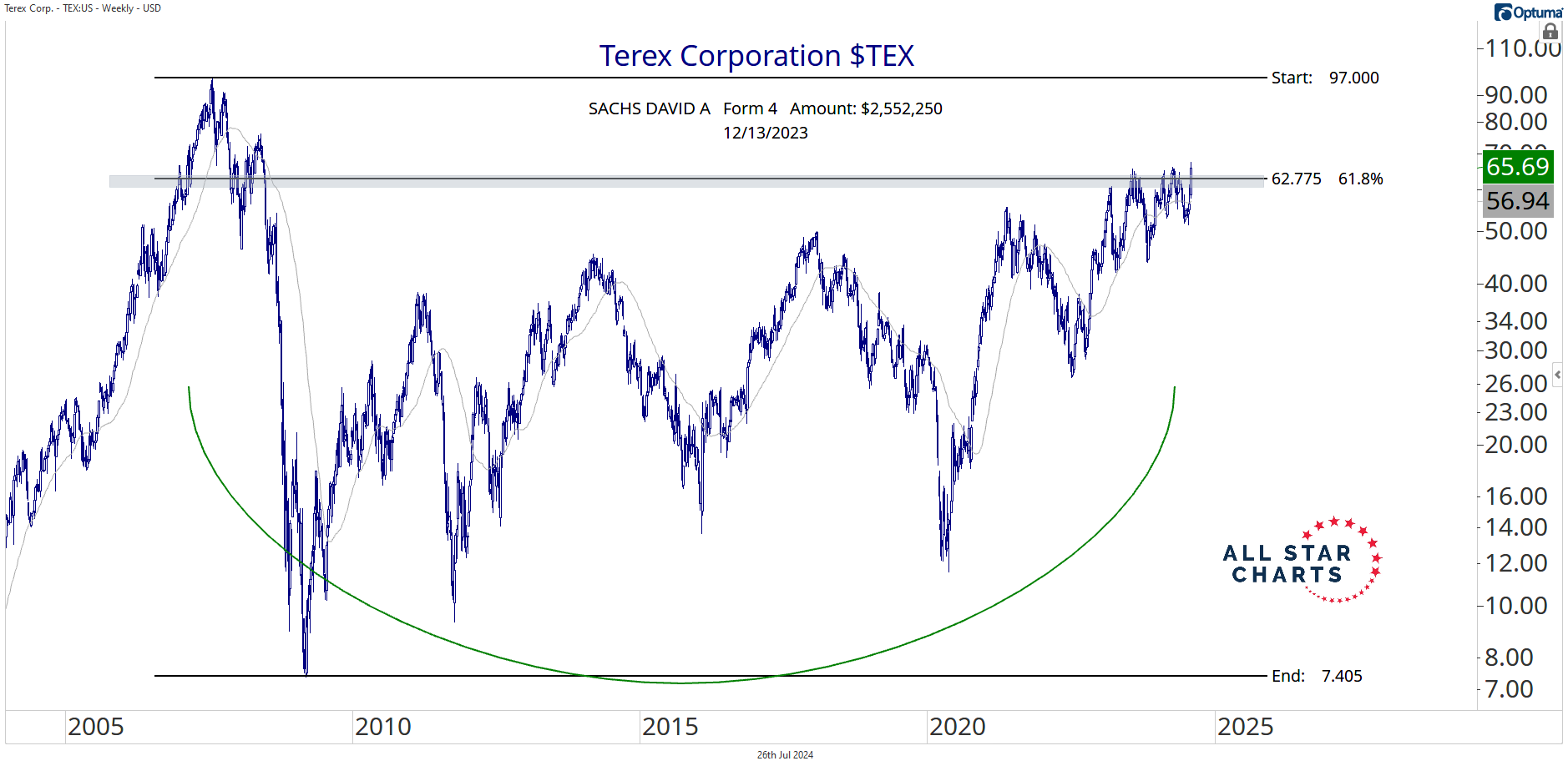

Next, we have Terex $TEX, a manufacturer of lifting and material-handling equipment:

In December last year, director David Sachs reported an acquisition of 50,000 shares.

Terex is reclaiming a key level of interest at the 61.8% retracement of the prior drawdown and is making new 16-year highs.

We want to own TEX if it’s above 62.75, with a target of 97 over the coming 3-6 months.

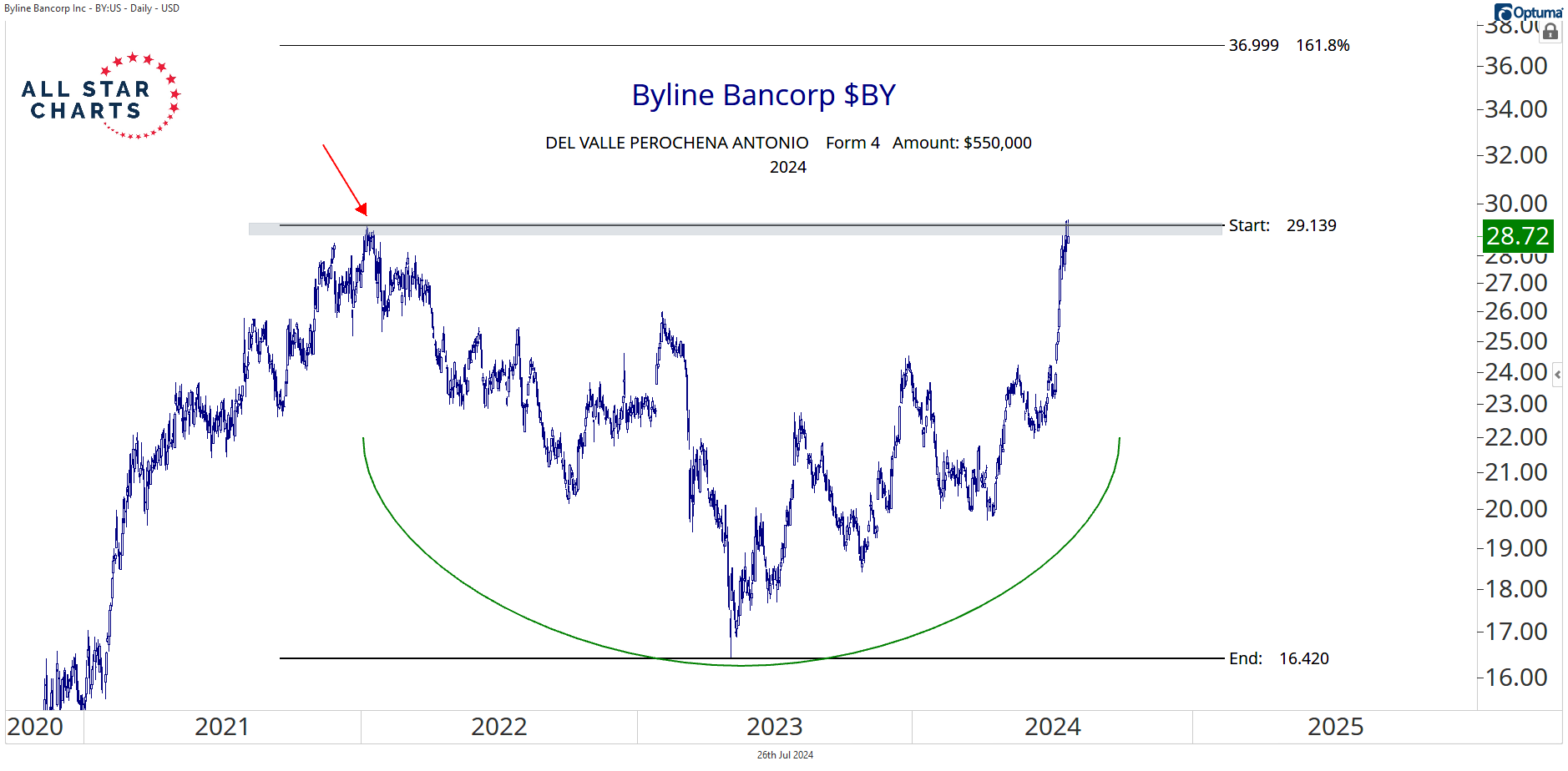

Here’s Byline Bancorp $BY, a company providing various financial services in Chicago:

During the first quarter, director Antonio del Valle Perochena revealed multiple purchases worth roughly $550,000.

BY has been building a constructive basing pattern for roughly three years now. Momentum has accelerated in the past few weeks, and the stock is currently challenging the upper bounds of the range.

If and when we get a decisive breakout, we want to be involved.

We’re only buyers on strength above 29. We’re targeting 37 over the coming 2-4 months.

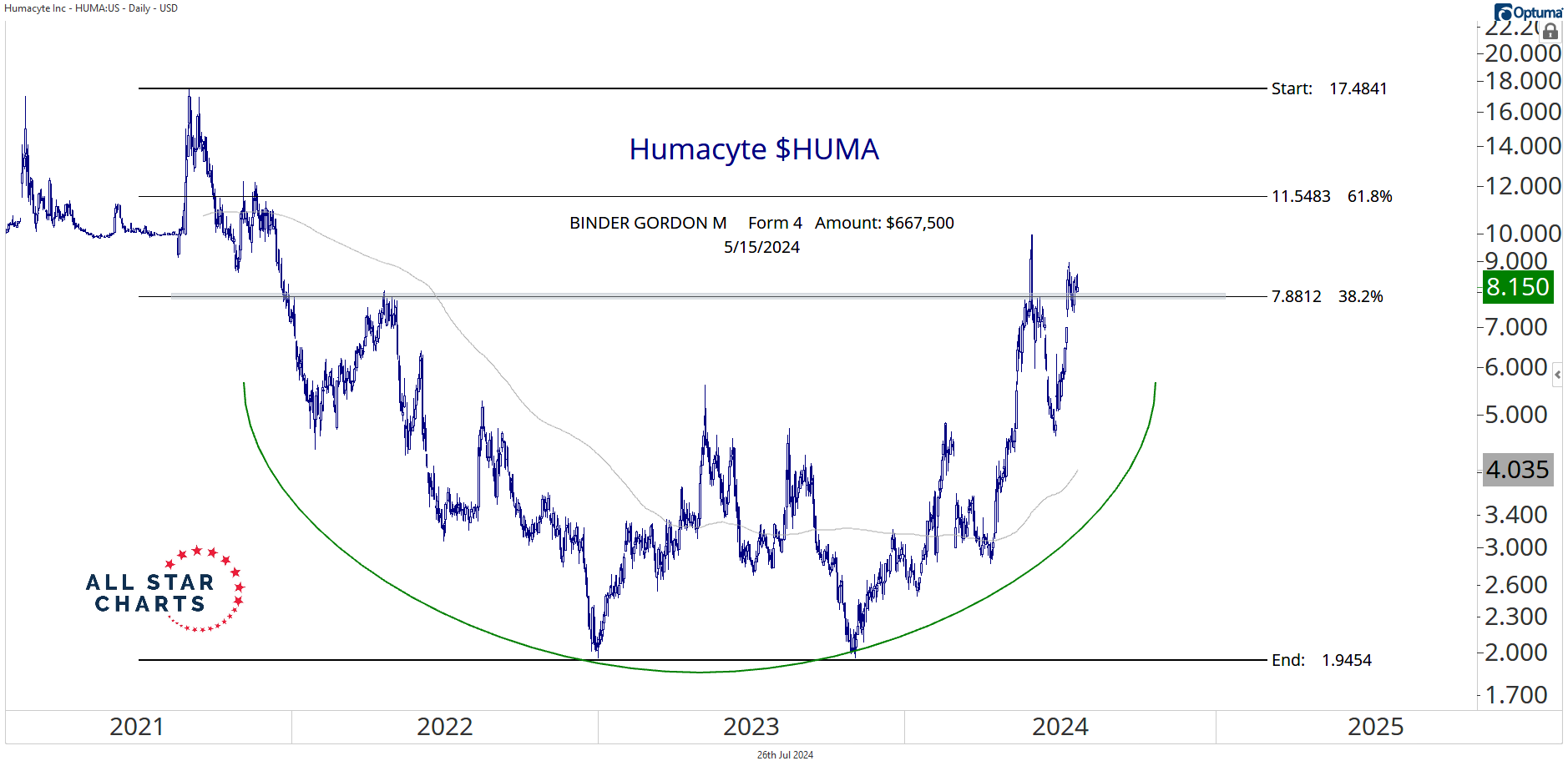

Our final setup is Humacyte $HUMA, a biotech company that’s developing bioengineered human tissue:

Director Gordon Binder revealed a position worth $667,500 in his latest Form 4 filed in May.

After suffering a significant drawdown from its 2021 peak, Humacyte has carved out a constructive bearish-to-bullish reversal.

Price is currently challenging a critical level of resistance at the 38.2% retracement.

As long as we're above 7.90, the path of least resistance is higher and we want to own HUMA with a target of 11.50 over the next 1-3 months and a secondary objective of 17.50 over longer timeframes.