Our first setup of the day is a $48.4B home construction company, Lennar Corporation $LEN.

In April, director Amy Banse filed a Form 4 revealing a purchase worth $247,275.

The stock has been grinding higher steadily since it broke out of a monster base in 2020. Right now, buyers are digesting the latest gains as price coils in a tight consolidation at the 261.8% extension.

We're betting that over time, LEN will continue its ascent in the direction of the underlying trend.

As long as we’re above 170, we want to be long LEN with a target of 273 over the next 6-12 months.

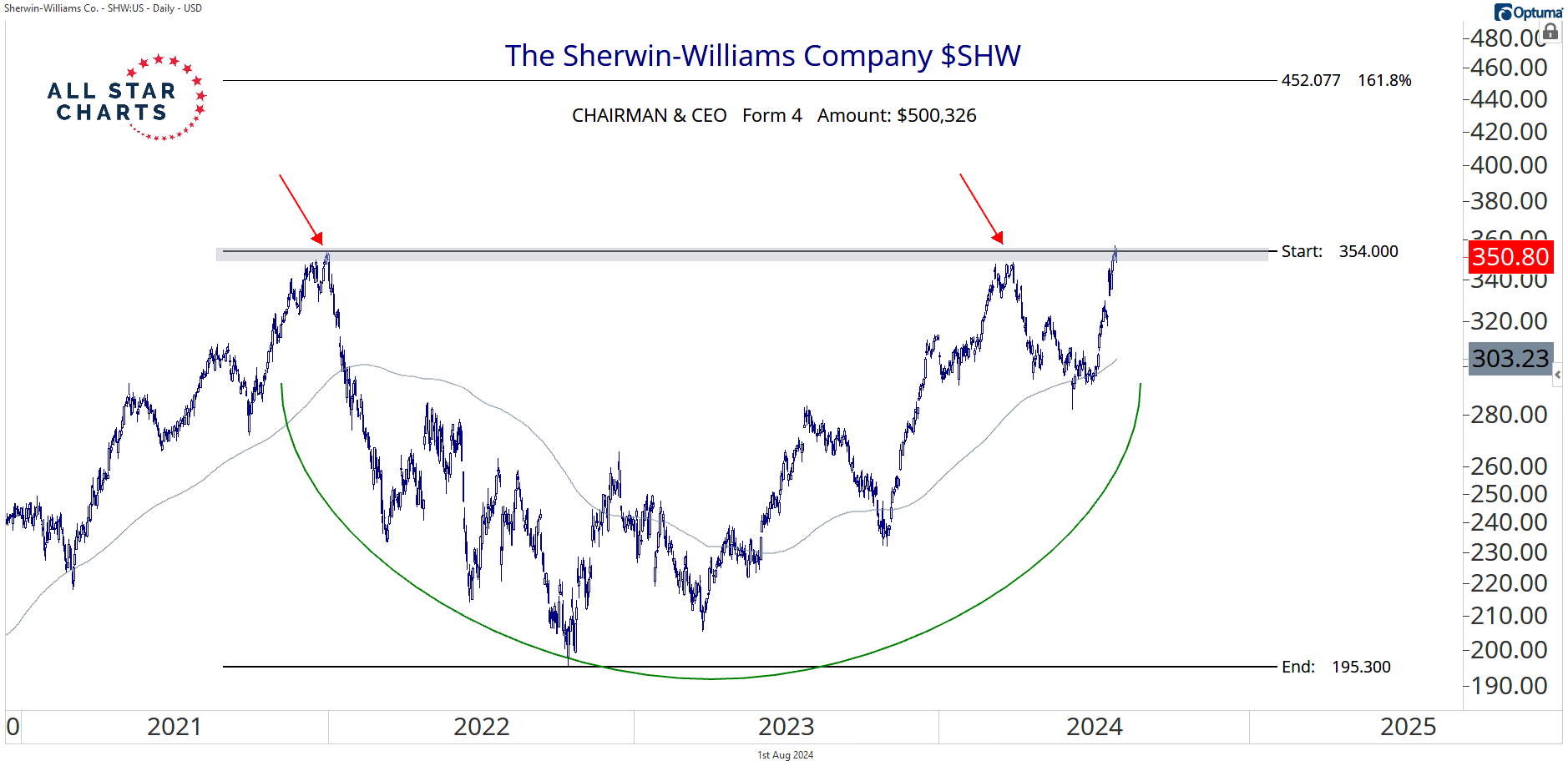

Here’s The Sherwin-Williams Company $SHW:

In January 2023, the chairman and CEO John G. Morikis revealed a purchase of half a million dollars.

SHW has been carving out a big basing pattern for the past two years.

Price is pressing against the upper bounds of the range now as buyers work on absorbing the overhead supply at this resistance level.

If and when we get a decisive breakout above 354, we can be long with a target of 452 over the next 3-6 months.

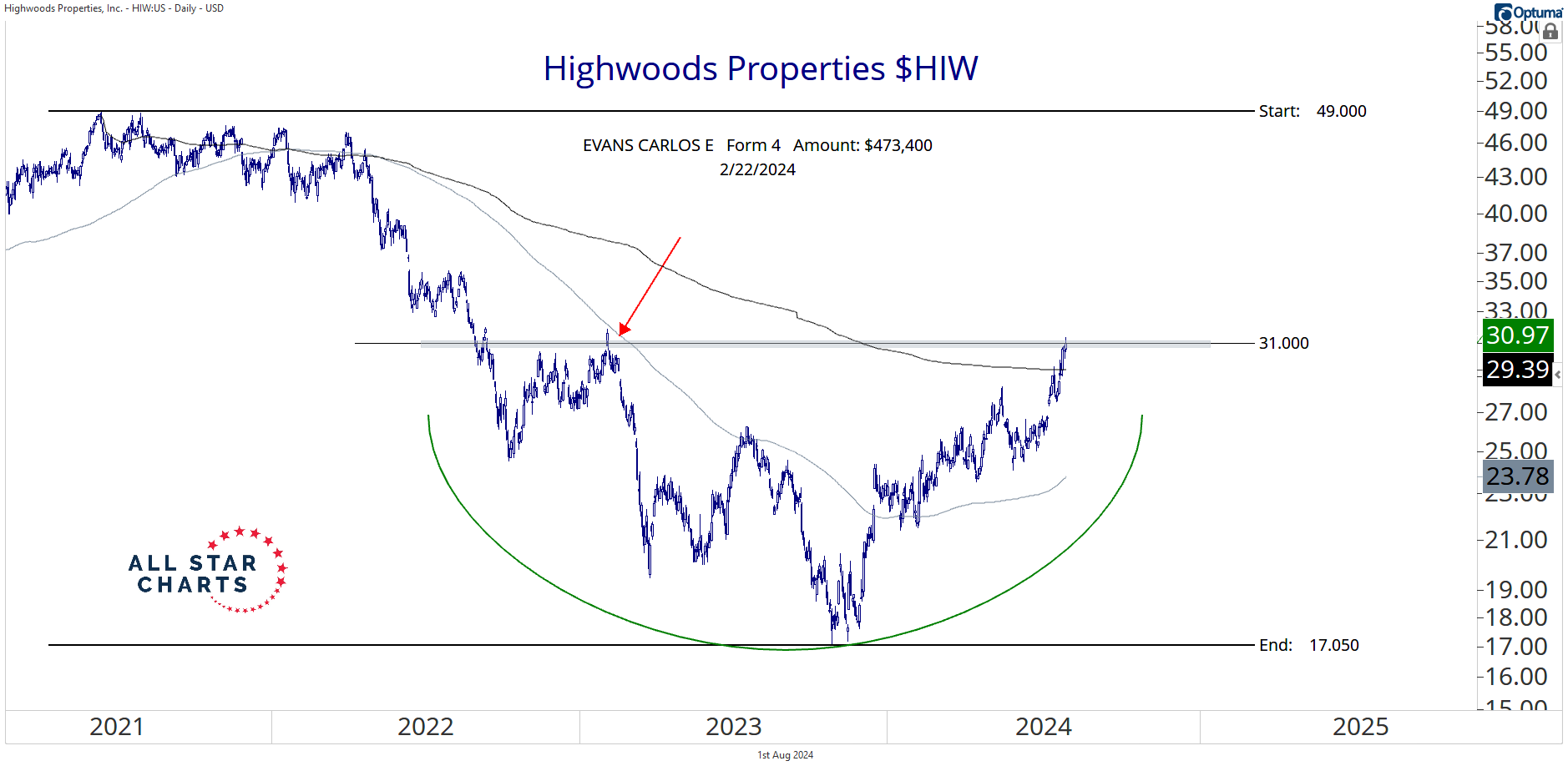

Last but not least, we have a $3.3B integrated office real estate investment trust. This is Highwoods Properties Inc $HIW:

In February, chairman of the board Carlos E Evans reported a purchase of 20,000 shares, equivalent to $473,400.

The stock has built a constructive reversal pattern for the past 18-months. Price is currently pressing against the 38.2% retracement of the 2021-2023 decline, giving us a logical place to define our risk and get long.

We want to be buyers, but only on strength above 31 with a target of 49 over the coming 3-6 months.

Have a great weekend, everyone!