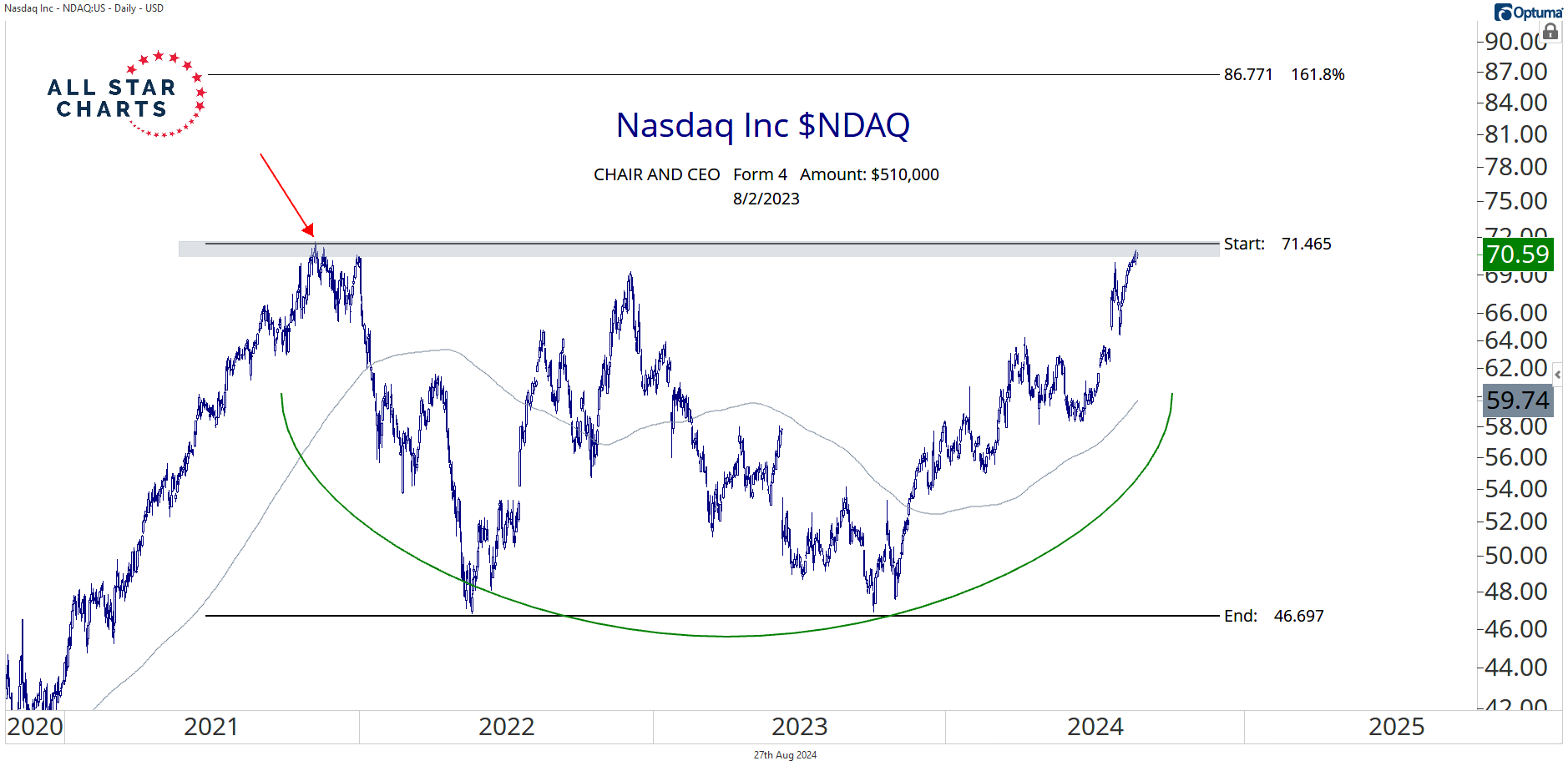

Our first setup of the day is the Nasdaq Inc $NDAQ:

One year ago, the chair and CEO, Adena Friedman, announced a purchase of 10,000 shares.

As you can see, NDAQ is in the process of completing a multi-year consolidation pattern.

If and when it reclaims its prior cycle peak from 2021, we believe this stock will kick off a fresh leg higher.

We want to wait for a decisive resolution above 71.50 to get long NDAQ. We’re targeting 87 over the next 1-3 months.

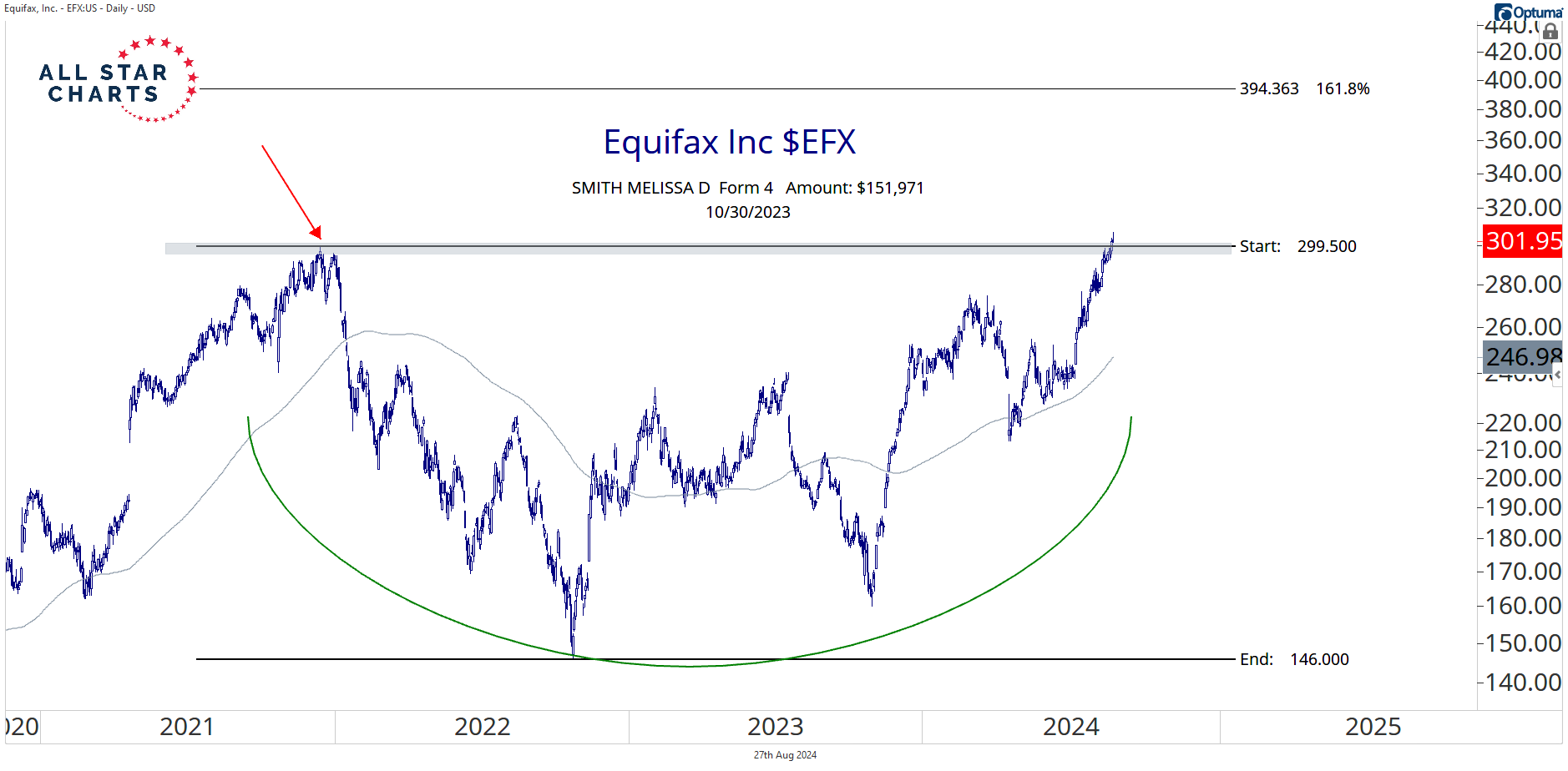

Last but not least, we have a $36B consumer credit reporting agency Equifax Inc $EFX:

In October last year, director Melissa D. Smith revealed a purchase of $151,971.

The stock is putting the finishing touches on a three-year basing pattern.

Price is currently challenging a critical resistance level.

We’re buyers only on strength above 300 with a target of 400 in the coming 2-4 months.

Have a great week, everyone!