Topline Capital Management filed a 13G for Green Dot Corporation $GDOT, revealing an increase from 5.25% to 11.40%. This represents an additional investment of roughly $35 million.

Last but not least, director Kristiina Vuori revealed a purchase of $100,005 in Inhibrx Inc $INBX.

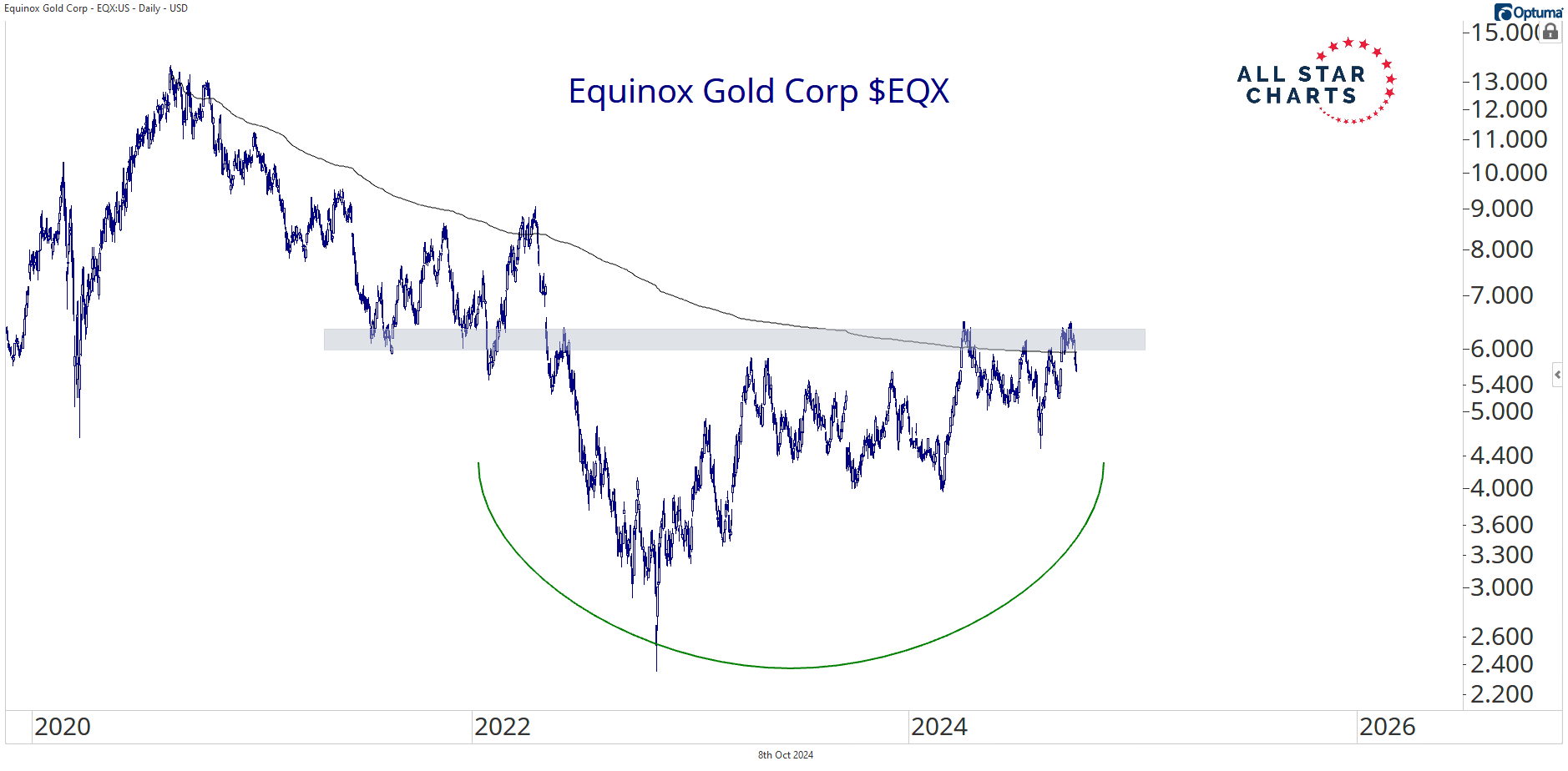

EQX has been working on a rounding bottom for over a year as buyers try to take control and establish a new uptrend for the gold miner:

We like this one a lot, especially considering the strength from precious metals stocks these days.

We’ll be looking to get long on strength above the breakout level as soon as we get it.

However, the bias is sideways for longer if we remain trapped beneath this polarity zone and the VWAP from the prior-cycle highs.

We want to be patient for now. But I have a feeling we’ll be talking about EQX a lot more to Hot Corner Insiders in the future.

Stay tuned. We'll be back on Wednesday with more insider activity.

And please reach out with any questions. We love hearing from you!

For questions about your membership, contact us at 323-421-7910 or info@stockmarketmedia.com