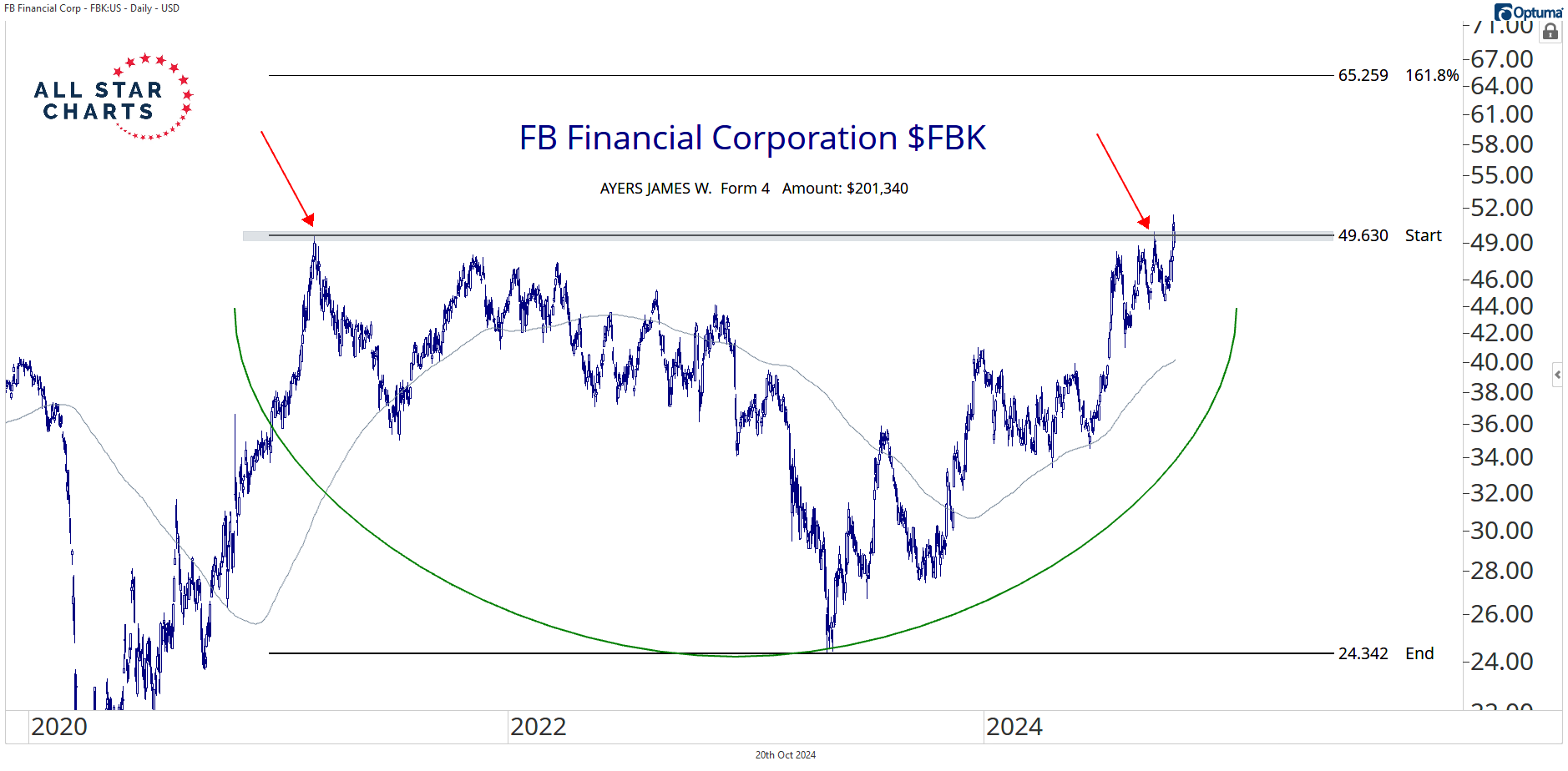

Our first setup of the day is FB Financial Corp $FBK.

On Friday, former director James Ayers bought 4,000 shares, equivalent to $201,340.

We mentioned this one earlier this year as it was resolving higher from a short term bottom.

Fast forward to today, and FBK hit our target and is printing fresh all-time highs.

Now, the stock looks poised to break out of a 3-year basing formation and embark on a new leg up.

Our line in the sand lies at 49.50 since it represents the peak of the prior cycle. We’re above that level, then the path of least resistance will be higher.

We’re long against 49.50 with a 3-6 month target of 65.

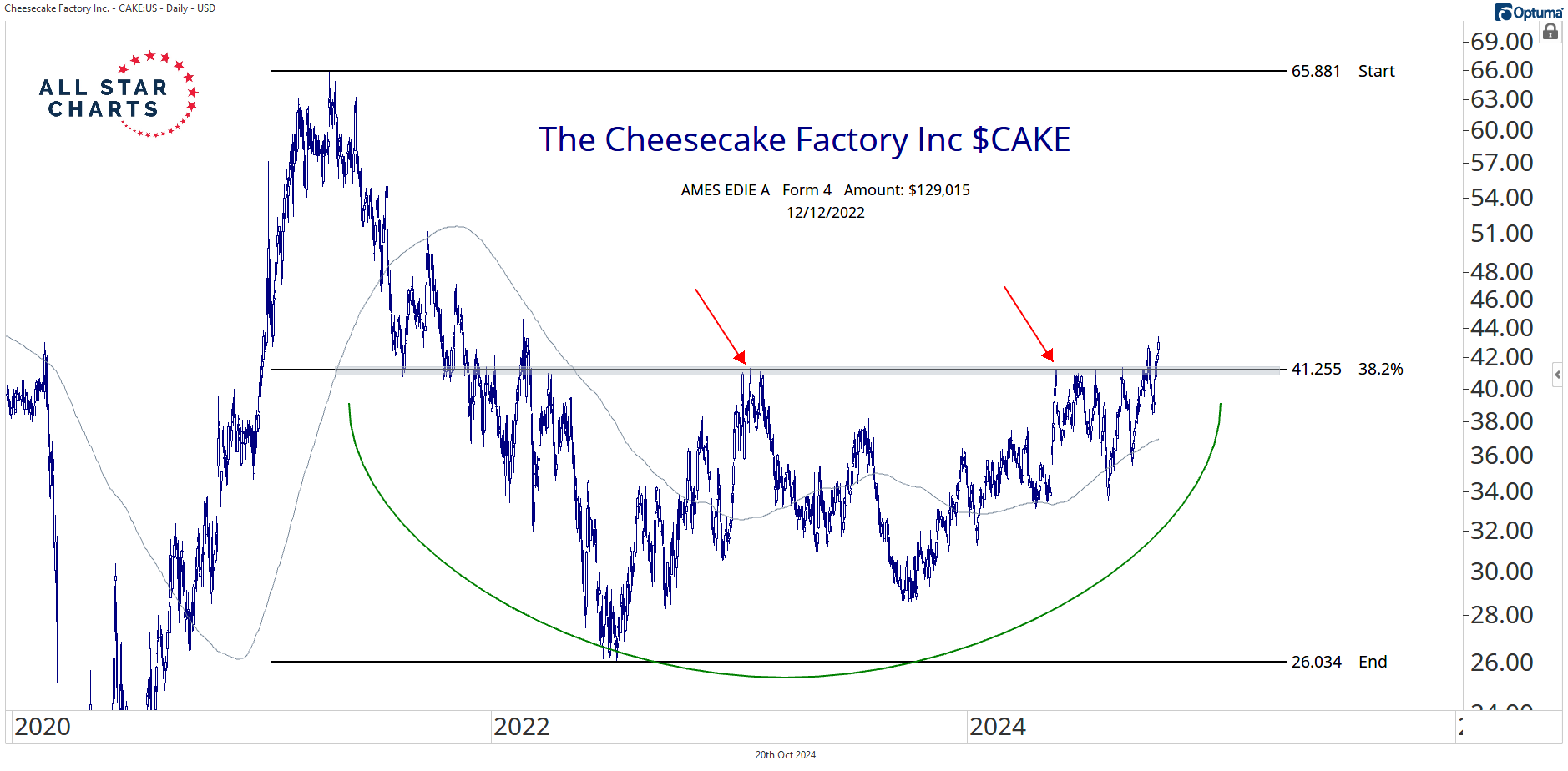

Last but not least, we have a $2B company that operates and licenses restaurants in the United States and Canada. Here’s Cheesecake Factory $CAKE:

In December 2022, director Edie A. Ames revealed a purchase of $129,015.

CAKE has been carving out a bearish-to-bullish reversal pattern for roughly three years.

This is what a classic accumulation pattern looks like in the early stages of a trend reversal.

As you can see, buyers are attempting to take out the upper bounds of this range, which coincides with the 38.2% retracement, making it a logical place to define risk.

We want to buy CAKE above 41, with a target of 66 over the coming 3-6 months.

Have a good week everyone!