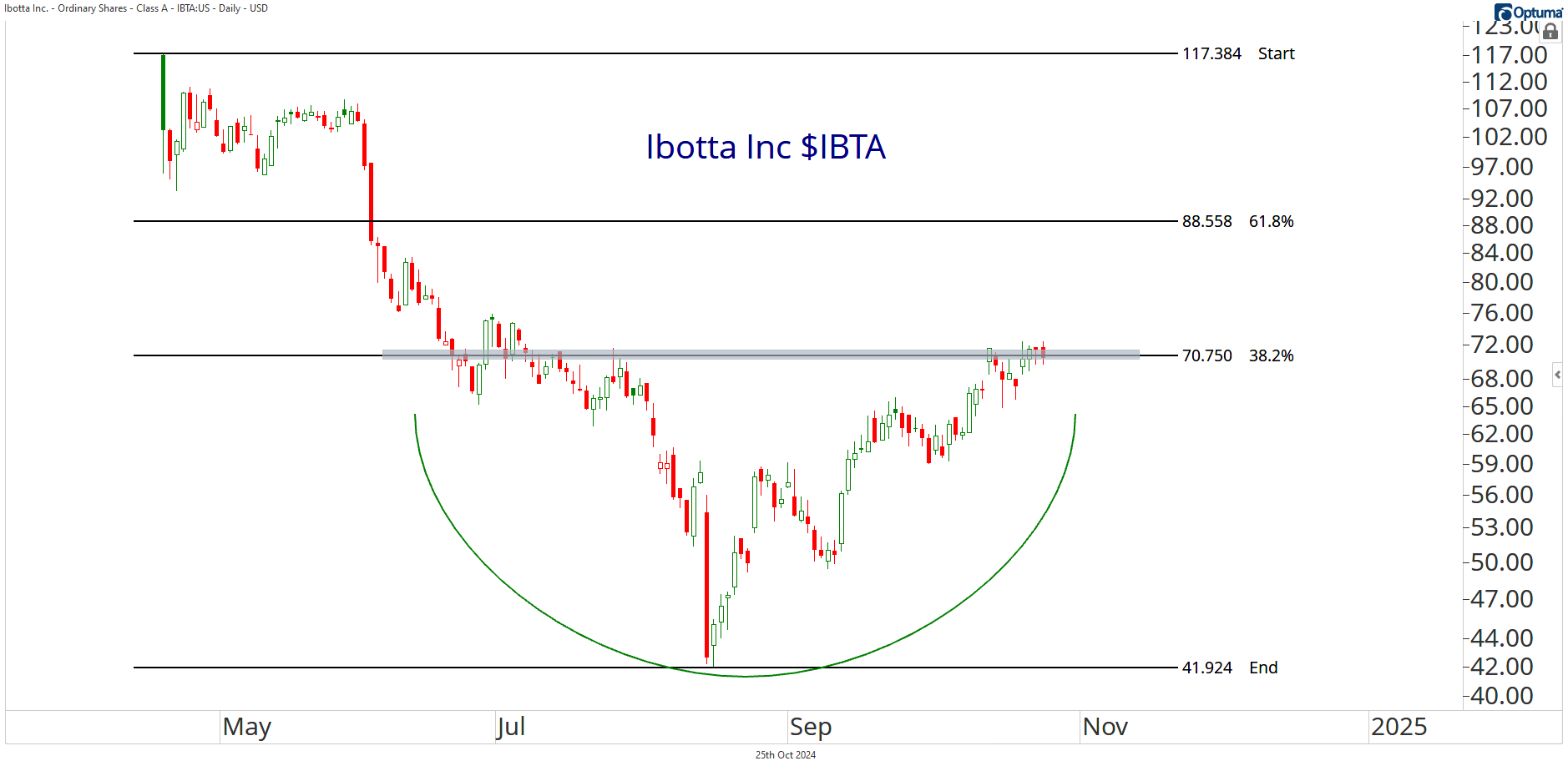

Ibotta went public on April 18 but immediately plummeted 60%. However, by mid-August, it found its footing and established a tradable low.

Since then, IBTA has been carving out a short-term reversal pattern with a V-bottom shape:

Price is currently testing the 38.2% retracement level.

If and when this level of 70.75 is reclaimed, we can start thinking of a valid trend reversal.

Have a great weekend. We'll be back on Monday with more insider activity.

And please reach out with any questions. We love hearing from you!

For questions about your membership, contact us at 323-421-7910 or info@stockmarketmedia.com