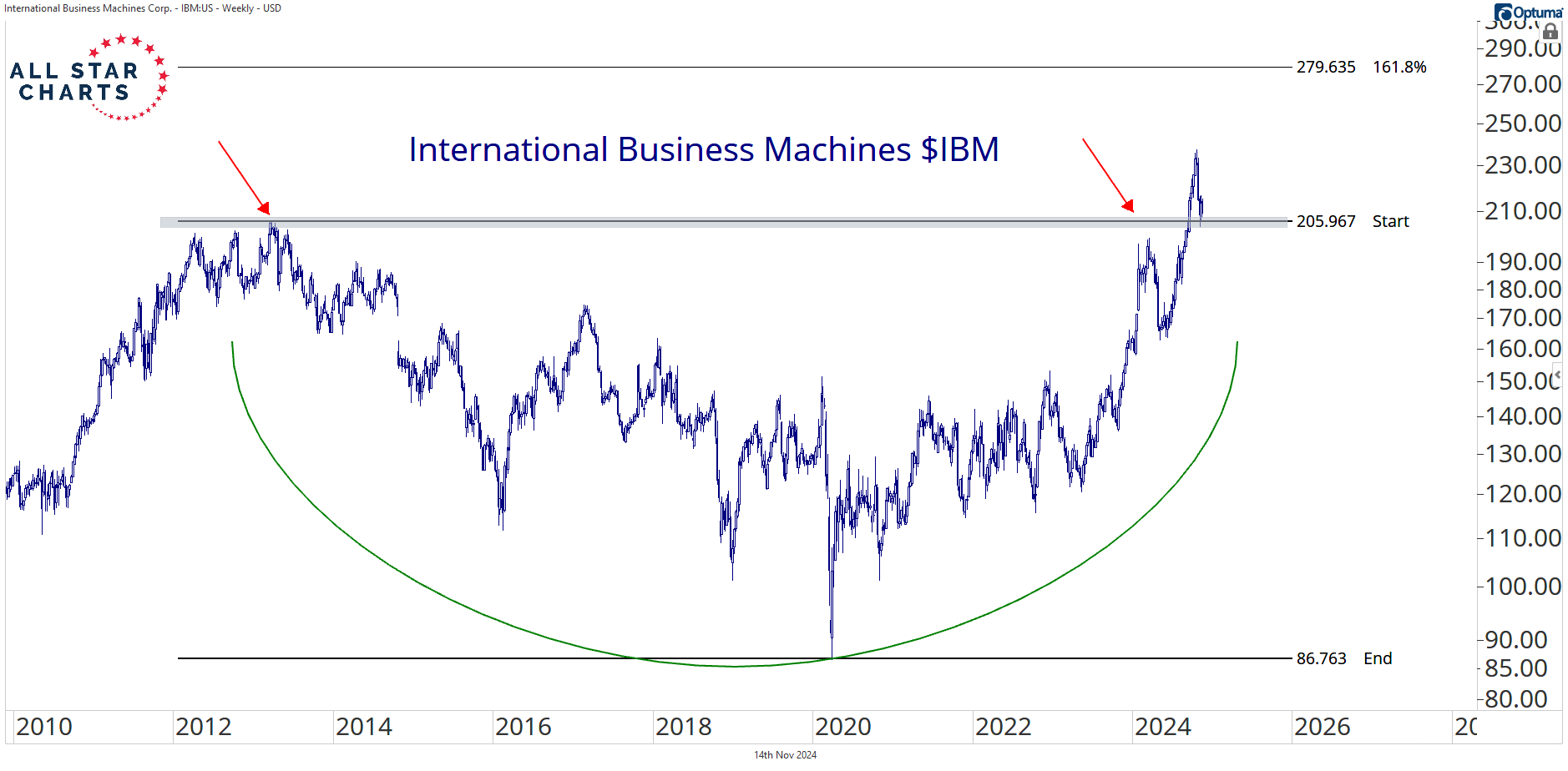

This represents a logical level to define risk and catch this trade if you missed the breakout two months ago. We want to stay long IBM as long as we’re above 205.

Stay tuned. We'll be back on Friday with more insider activity.

And please reach out with any questions. We love hearing from you!

For questions about your membership, contact us at 323-421-7910 or info@stockmarketmedia.com