🔎 The World Breaks Out. Argentina Breaks Down.

📊 Daily ETF Overview

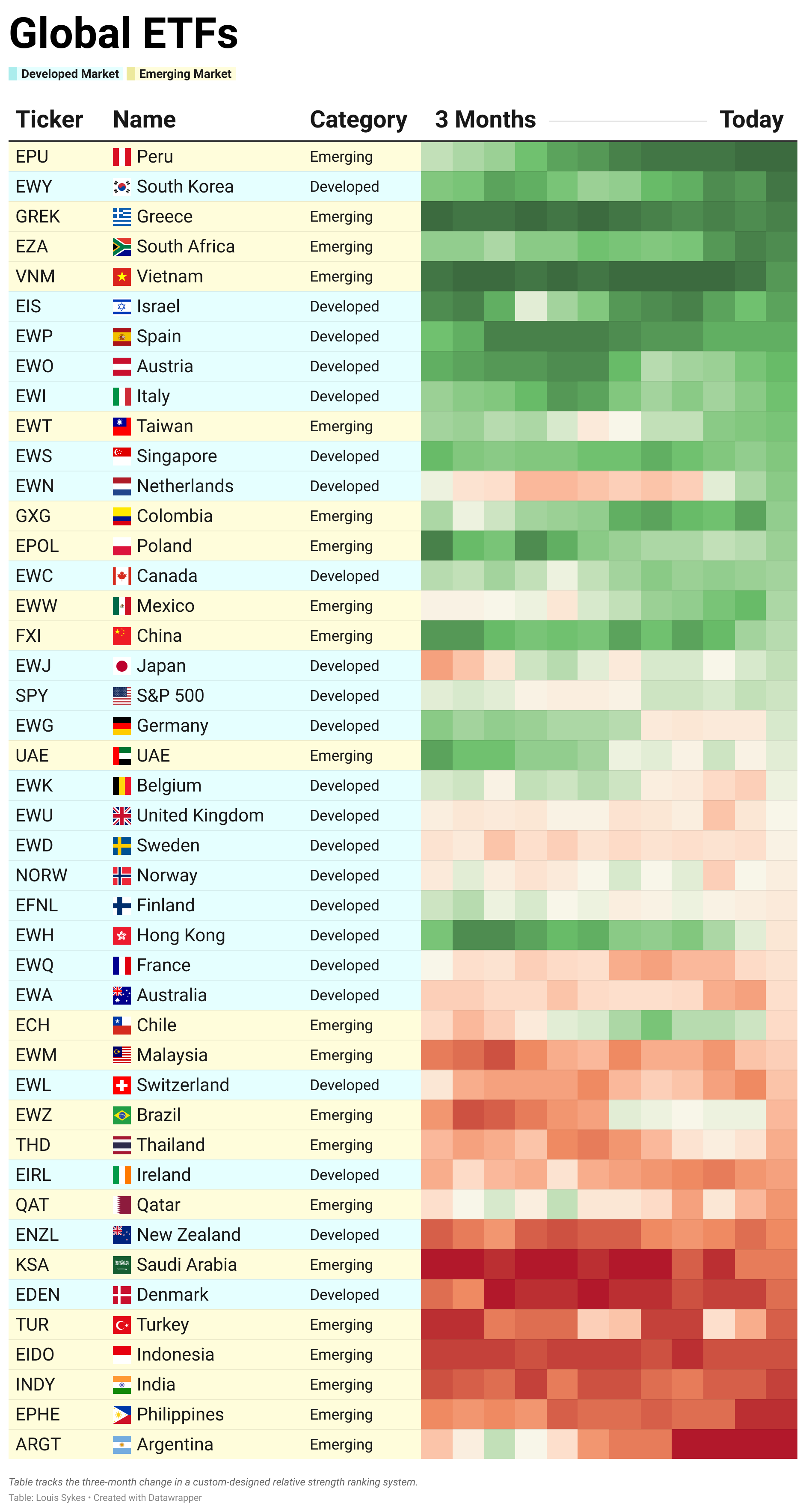

The rotation into global markets remains strong heading into year-end, with one notable exception: what was once among the strongest of them all — Argentina’s $ARGT.

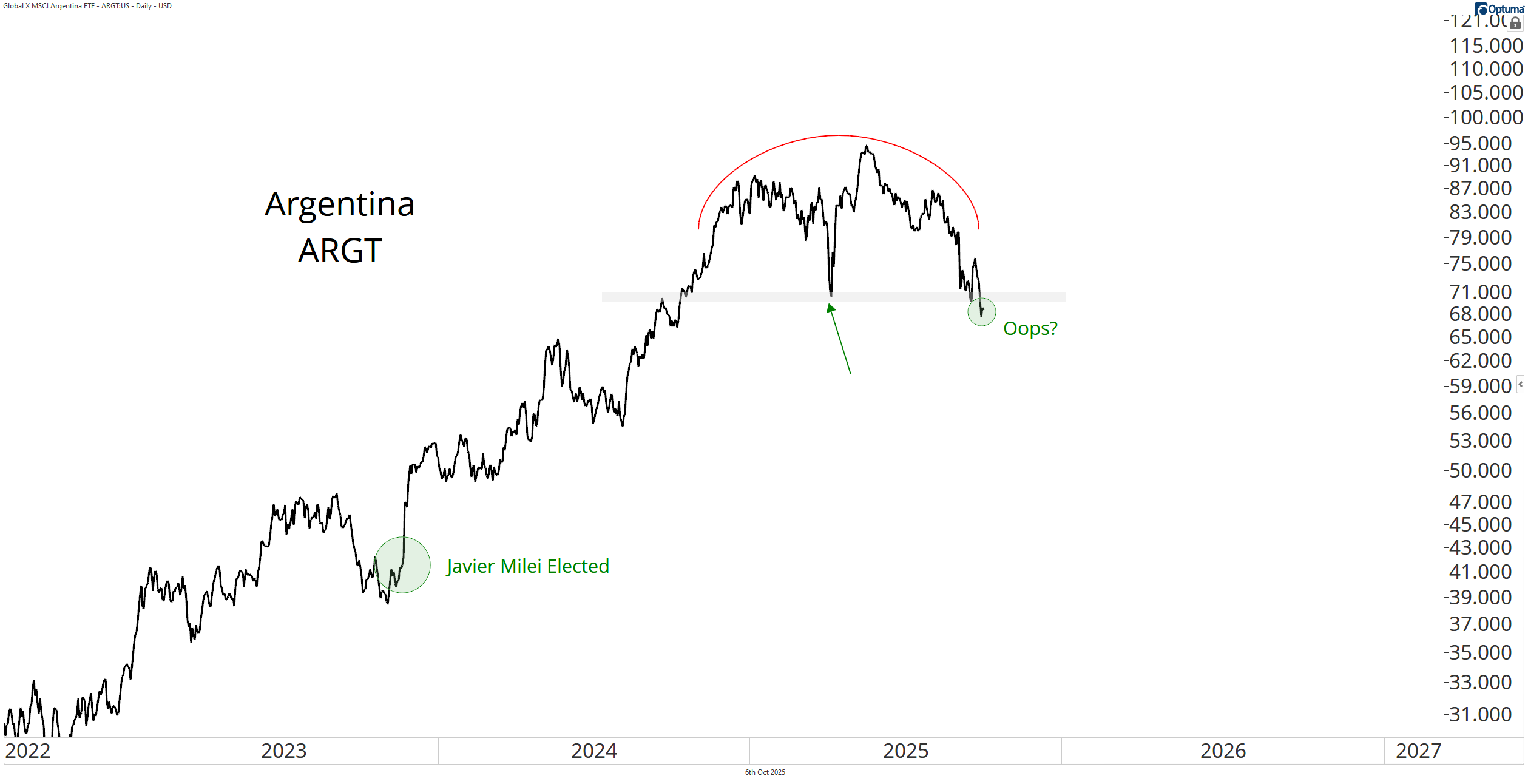

After Javier Milei was elected in late 2023, the Argentinian market took off in a major way. His sweeping economic reforms and deregulation helped ARGT surge 83%, marking one of its strongest year-over-year returns on record.

More recently, however, the Milei government has faced political setbacks and the Argentinian market has stumbled alongside it. The ARGT ETF has broken to new lows and now ranks as the weakest on our list.

Investors will be watching the Argentinian midterms later this month closely, given how tightly Milei’s reform agenda has correlated with market performance.

In an environment where so many international markets are breaking out, we wouldn’t be surprised to see ARGT reclaim lost ground particularly if the uncertainty surrounding the midterms resolves productively.

This is an ETF we’ll be monitoring closely to see whether it can regain some of its former strength.

While Argentina struggles to find its footing, other opportunities are still thriving. Our Chief Options Strategist Sean McLaughlin’s Options Portfolio is up 100% in 2025.

He hosted a workshop to explain exactly how he did it, which you view by clicking here.