🔎 The Music is Blasting

📊 Daily ETF Overview

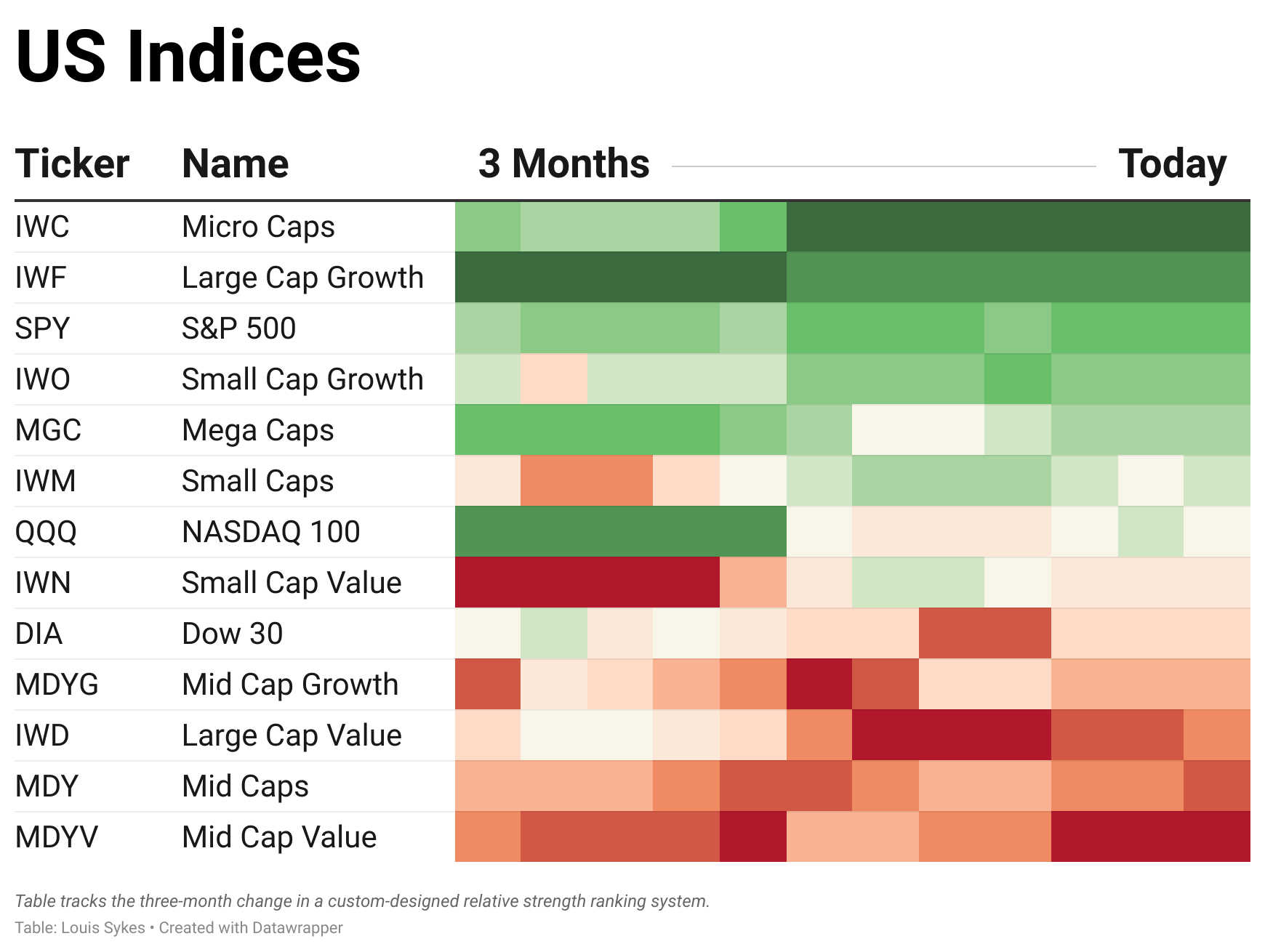

Moving over to our U.S. Index universe, the same theme keeps emerging: breadth. Market leadership is broadening out in a way we haven’t seen in years. Virtually everything is working right now.

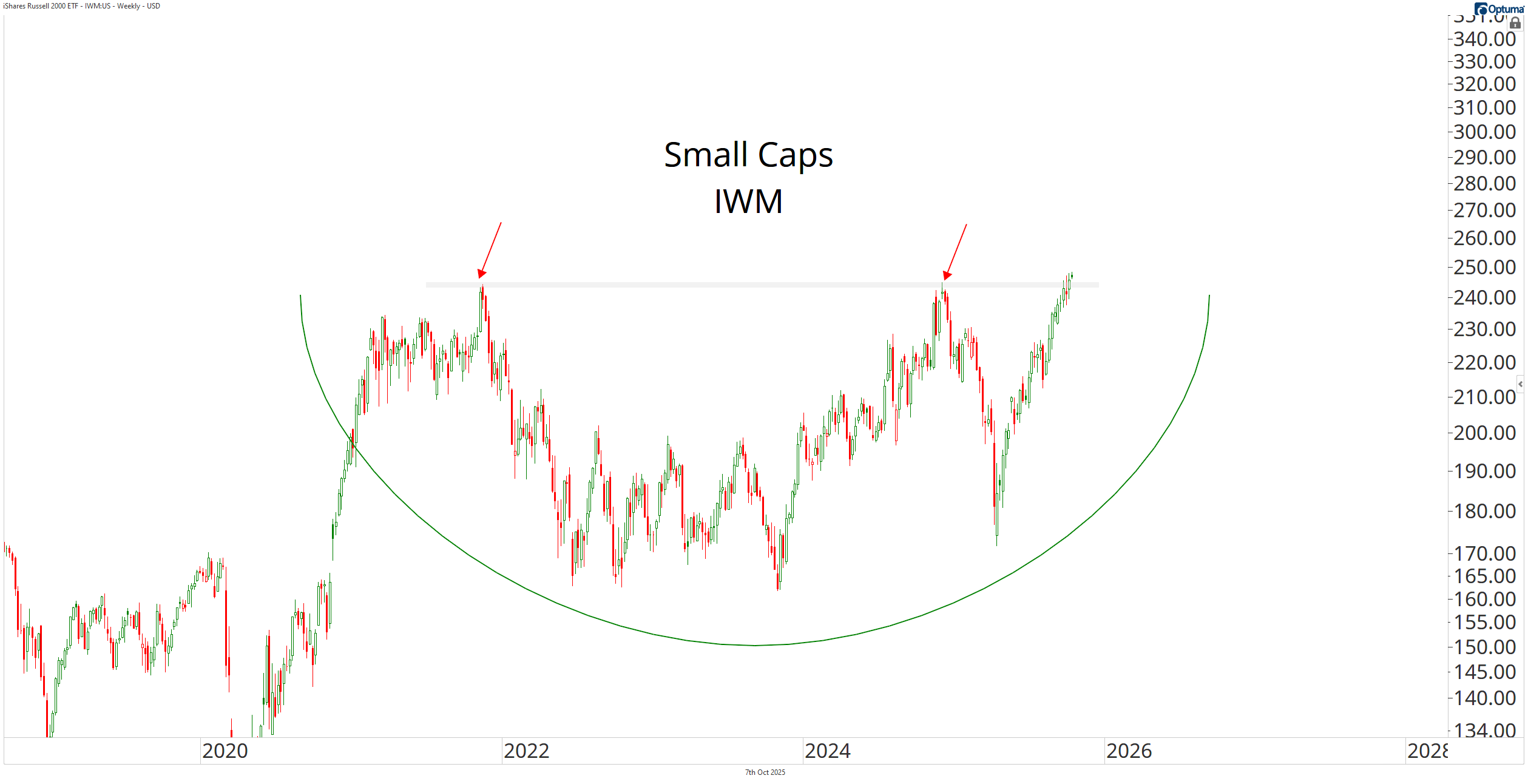

The most telling example of that strength comes from small-caps — by definition, the world’s weakest companies, the ones that haven’t yet graduated into large caps. Yet here they are, making new all-time highs. When even the laggards are leading, it tells you everything you need to know about the kind of market we’re in.

We’ve likely entered that short but powerful stretch of the cycle where everyone seems to be making money. These are the moments when taking on risk pays off the most, when the rising tide lifts all boats — even the leaky ones.

Of course, it doesn’t last forever. The music never does. But right now, it’s still playing, and it’s loud. That doesn’t mean to throw caution out the window, but it does mean to recognize the environment for what it is: one of those rare times when literally everything is working.

Someone who's really taking advantage of this environment is Sean McLaughlin. His options portfolio has doubled this year.

You see precisely how he did it, and how he'll be trading into the back stretch of the year by clicking here.