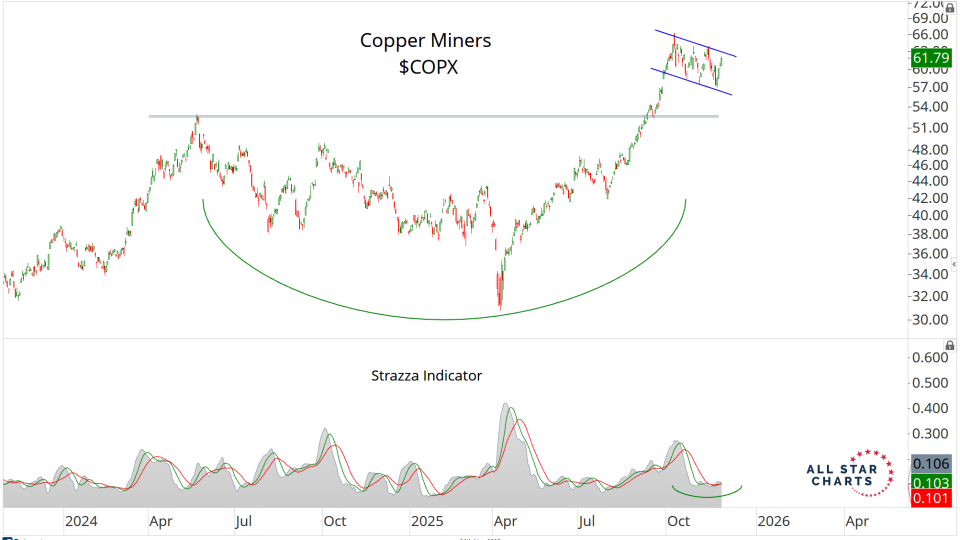

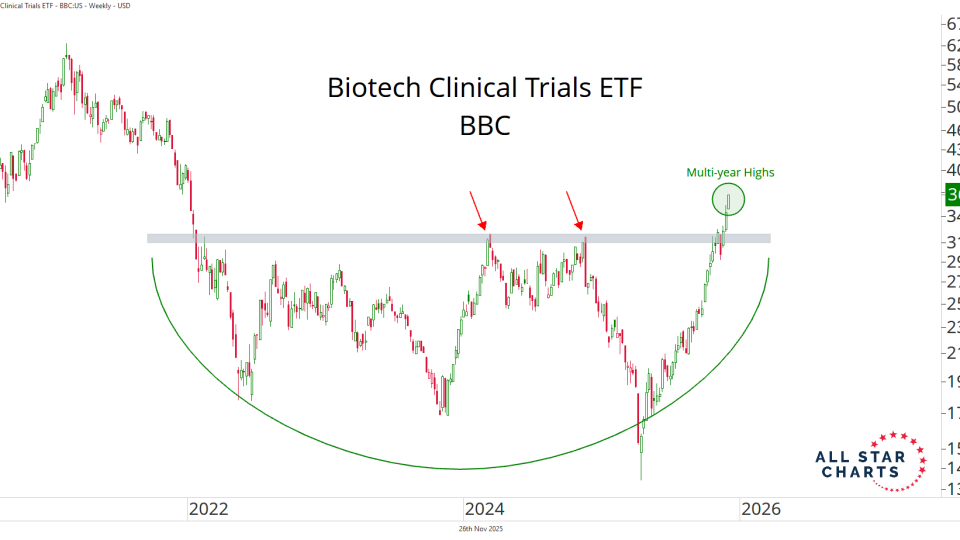

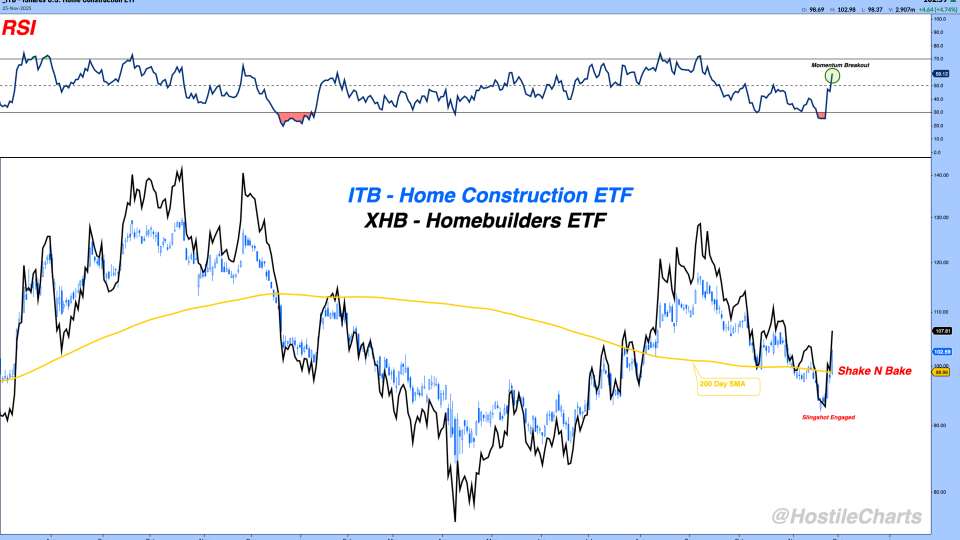

The Breakout We’ve Been Waiting For

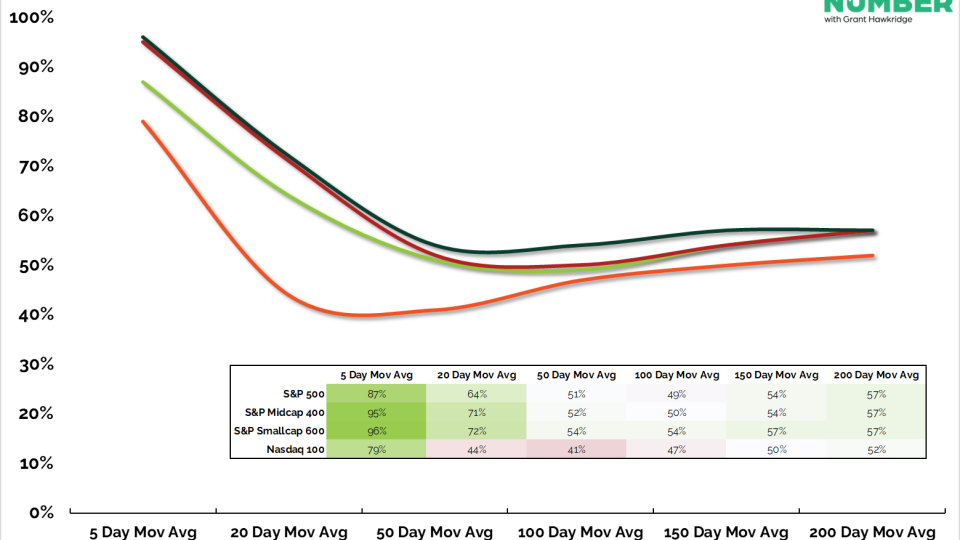

The biggest weekly rally since 2020 confirms a powerful shift in the primary trend.

March 6, 2026

Members Only

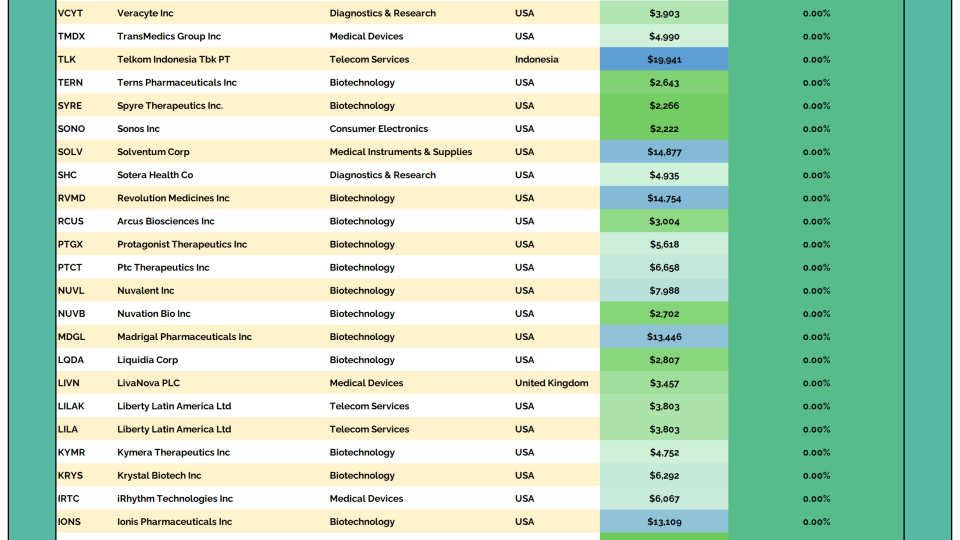

Displaying 1177 - 1200 of 21060

Recent Episodes

Missed it? No problem!

Replays of all our past episodes are always available in the episode archives.